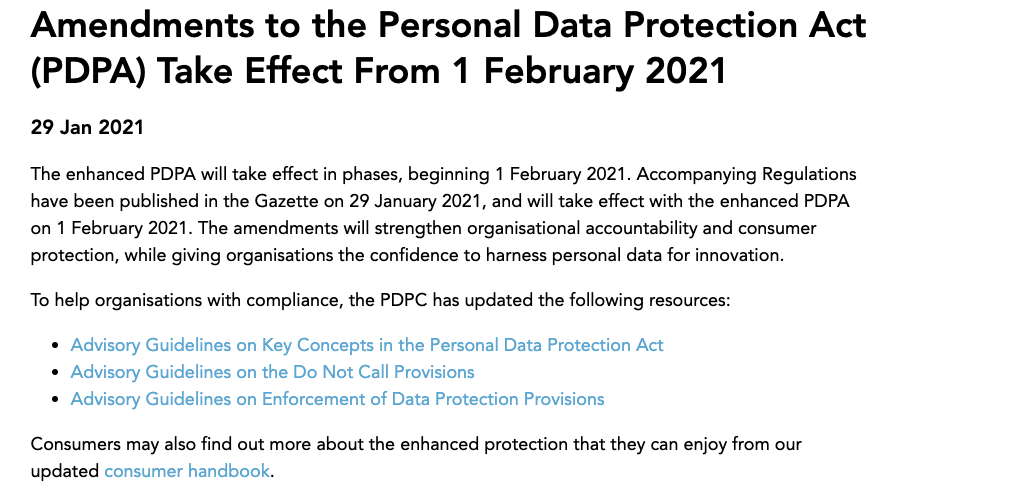

On 29 January 2021, the Personal Data Protection Commission (PDPC) announced that certain sections of the Personal Data Protection (Amendment) Act 2020 (the PDPA Amendments) will take effect from 1 February 2021 – please see PDPC’s announcement; the gazetted Commencement Notification. This legal update provides a high-level summary of the PDPA Amendments that have taken effect. The changes introduced by the PDPA Amendments to the Personal Data Protection Act 2012 (the PDPA) are the most significant since the PDPA first came into force on 1 July 2014. Please see our earlier blog post, Singapore tables changes to the Personal Data Protection Act in Parliament, discussing the key changes introduced by the PDPA Amendments. The PDPA Amendments will take effect in phases, with the following three key changes taking effect from 1 February 2021:

Comments are closed.

|

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |