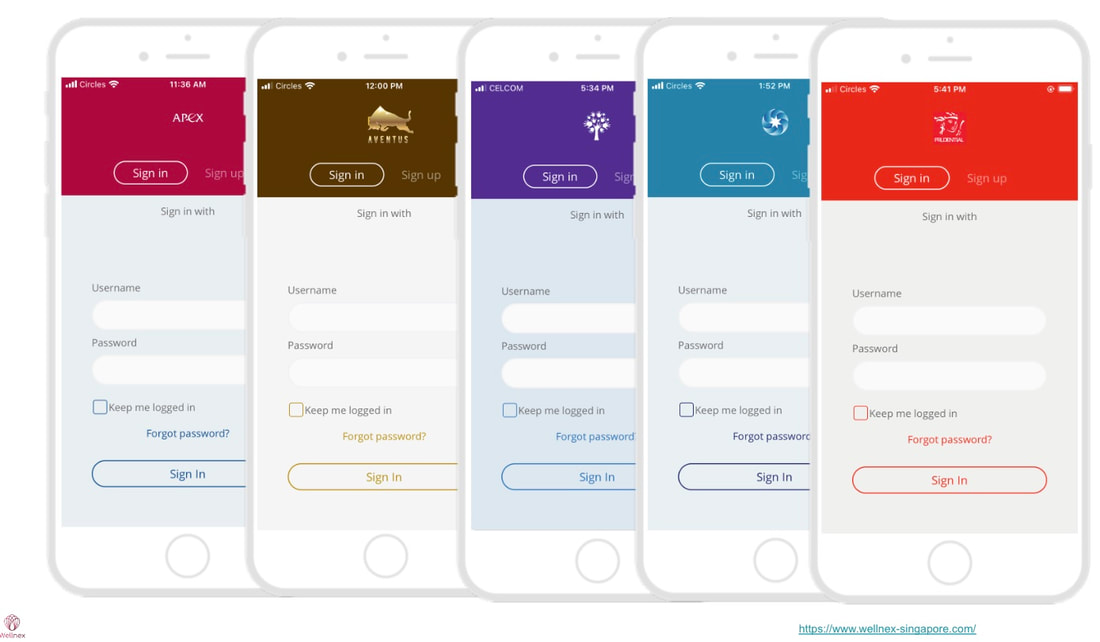

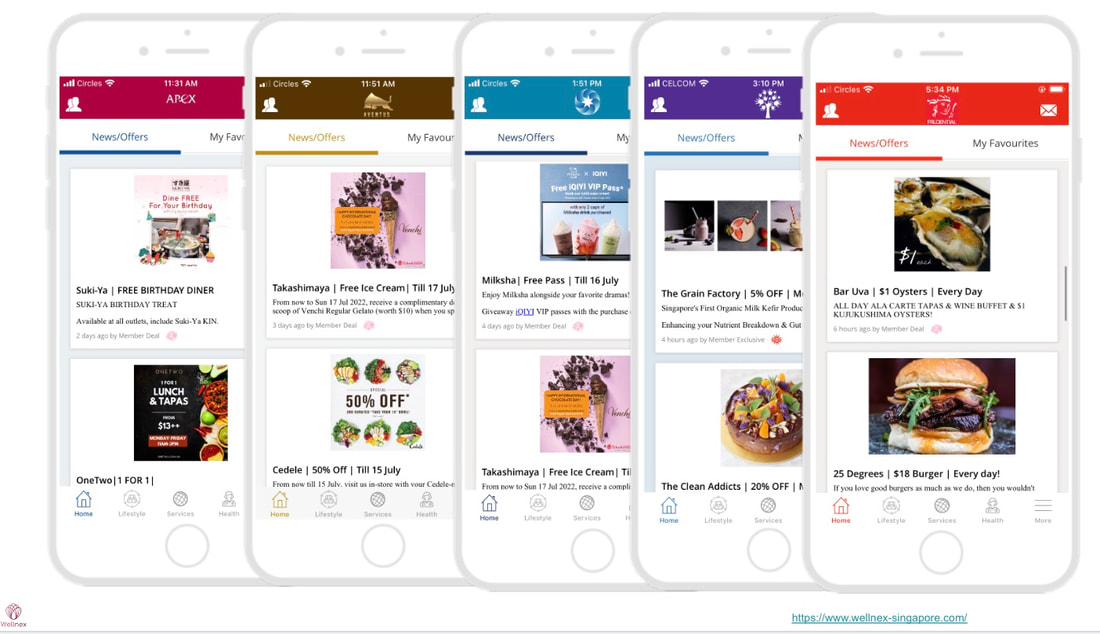

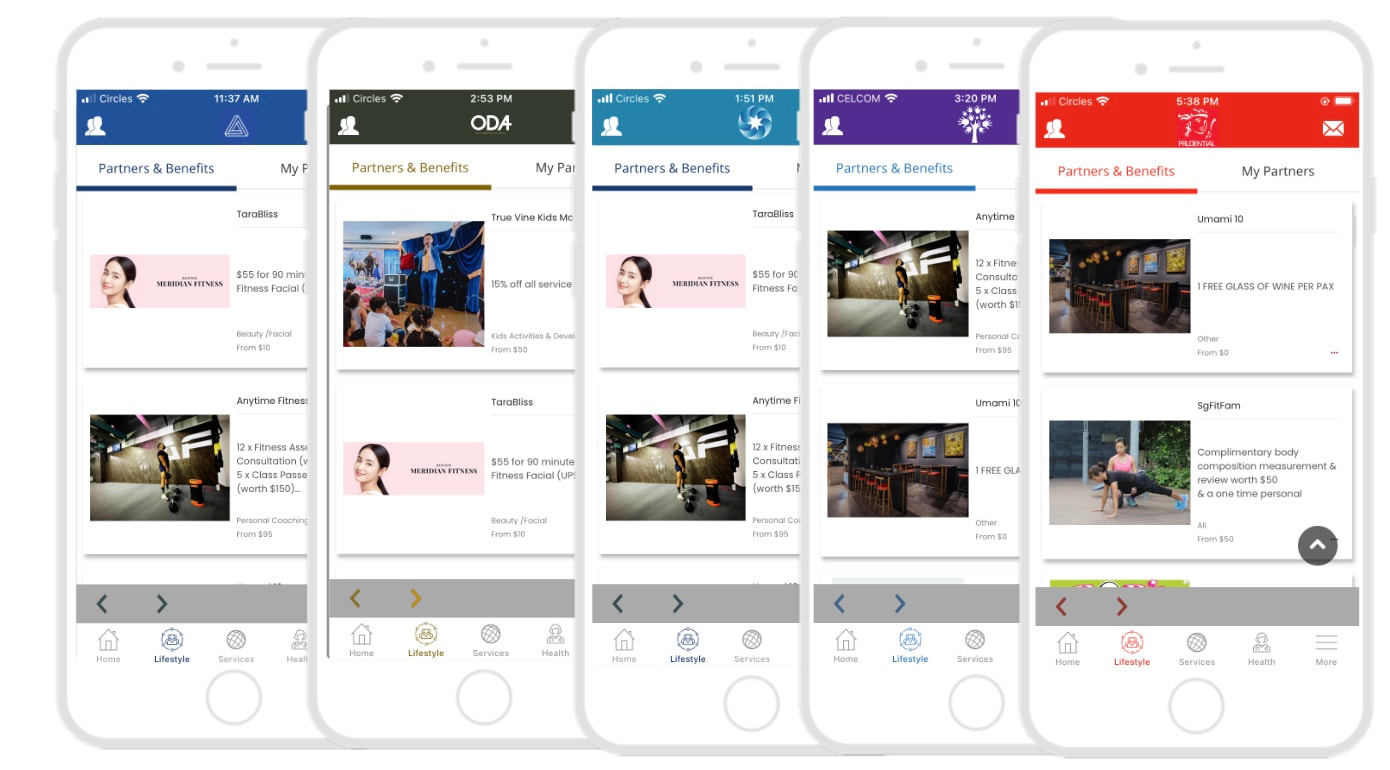

What if FINANCIAL ADVISOR FIRM or AGENCIES could get their very own app to manage differently their customers? What if they could have an app with their name on both Android and iOS, with the color and a full Branding of their company? What if they could get a Free Concierge to Serve their leads, clients and members? An app that could publish Relevant and Impactful Content on regular basis? An app that offer Unique & Discounted Healthcare & Lifestyle Services? An app that also would give them the opportunity to input the insurance they purchased through an insurance wallet? Dont search any further, Wellnex launched such capability! Announced Matthias de Ferrieres yesterday at a talk with major Financial Advisory Firms that opted to revisit their digital roadmap and signed with Wellnex White Label.  Financial Advisor and Agencies can now opt for their very own system where they will be able to collect and protect their data. They will unlimited access of the CRM, CSM, Portfolio Management and Lead Gen! All with the normal customer service support Wellnex provides since 2020. Advisory Firms that opt for Wellnex White Label will pay a monthly fee to have the app as mentioned earlier but also they have the guaranty that they will be able tocollect & store data safely, manage clients information, With total access and control of unlimited publications, tools that help them to do KYC/FNA or Financial Planning! It is a first in Singapore and in Asia  Matthias de Ferrieres, CEO of Wellnex, explained that there is a growing needs for Insurance intermediaries to digitalise themselves and Incumbents are still not up to speed. Matthias de Ferrieres added that with Wellnex white label they have the opportunity to brand themselves, create a real assets for their organization, offer something different to their clients that is really relevant and differentiating. Matthias de Ferrieres insisted that the Wellnex White Label Solution is delivered in less than 3 weeks and is confirmed to be safe, secured, compliant and foremost affordable. "We have been able to adapt to the budget of the small agencies that cannot afford to buy a full digital platform. It cost less per month than recruiting an admin staff that will do only 1/3 of what Wellnex White Label is able to deliver" stated Regine Lai, co-founder of My-Insurer Pte Ltd, the company that hosts Wellnex. "Now, FA firms can have something personalised, with good content in line with what they do and explain to their clients. All is managed in-house with our very own concierge. Financial Advisors invite their clients and we do the rest: Book Health Consultation or Home Services, Support in case any problem arises. We are their Admin Arm for smooth and outstanding services" Regine Lai concluded.  WELLNEX and my-insurer is proud to communicate about the promotion of Fiza Tuahhaini as our new Chief Operating Officer! As Wellnex is expanding to Malaysia and deploy its white label capabilities in Singapore, Matthias de Ferrieres adjusted the organisation to ensure that the company will be easily scalable. Fiza Tuahhaini will take over the operation of WELLNEX Malaysia on top of WELLNEX Singapore. Fiza has been in the insurance industry for more than 9 years. Her professional experience includes working with prominent insurers and Brokers and Financial Advisors. She left AXA Partners as an Operations Team Lead where she managed the team's performance and assisted in new member onboarding in Singapore and Malaysia. She later went on to Abacare where she honed her broking skills, focusing on employee benefits for SMEs and International Medical Insurance. Her expertise lies in customer experience, account management and operations. Fiza joined the team in June 2021 where she is leading the overall operations and assisting in the development of the business community of WELLNEX Singapore and WELLNEX Malaysia and assisting in the development of the business community of Wellnex. She is also a Certified General Insurance / Health (SCI). Please join us in congratulating Fiza Tuahhaini in her new role! |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |