|

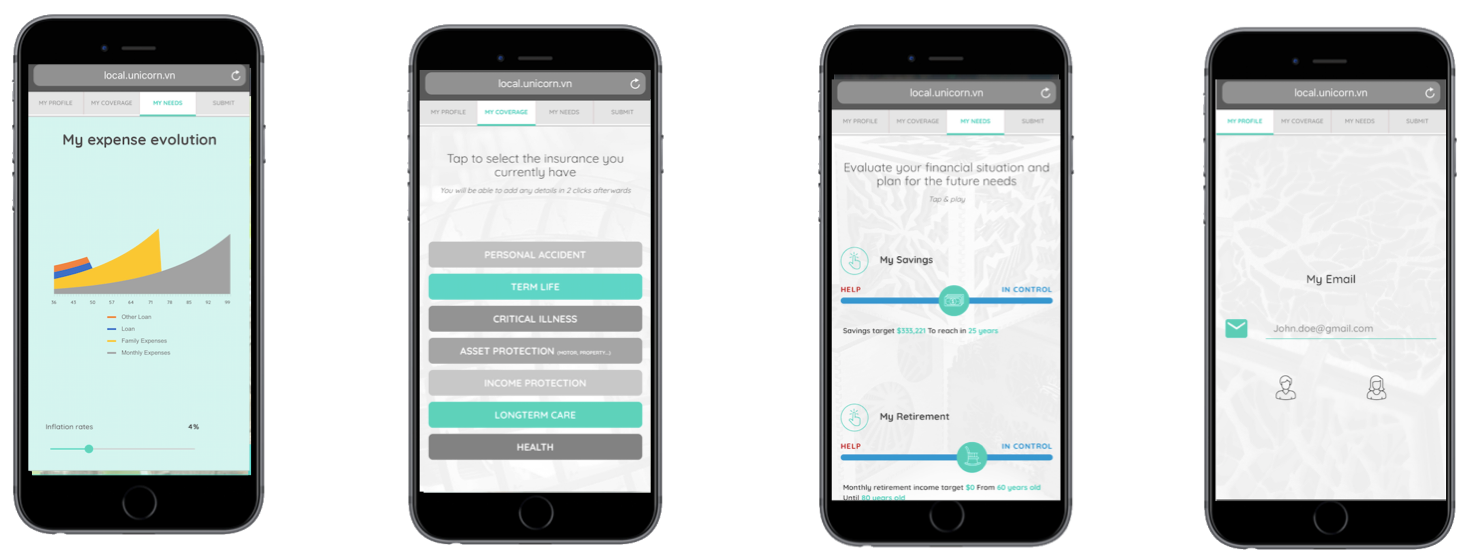

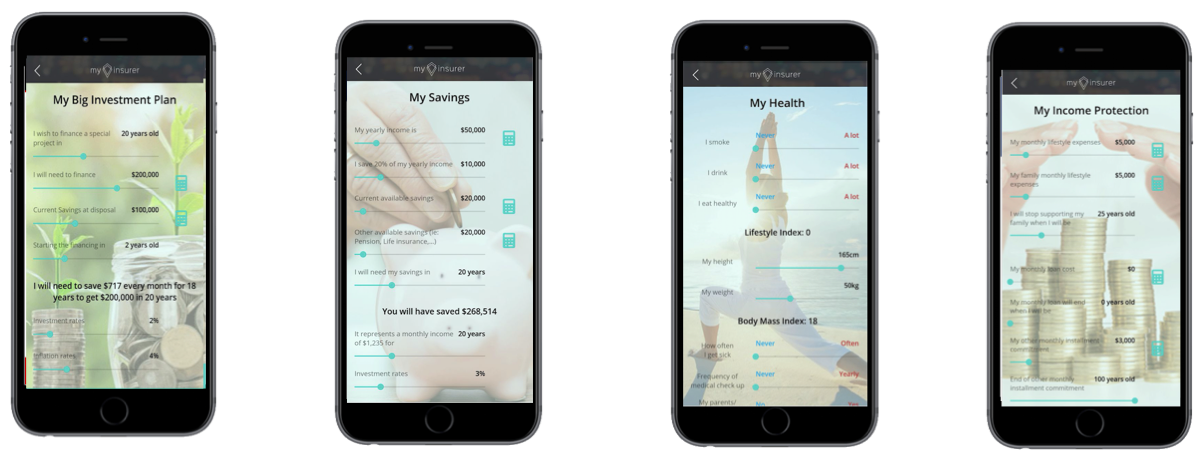

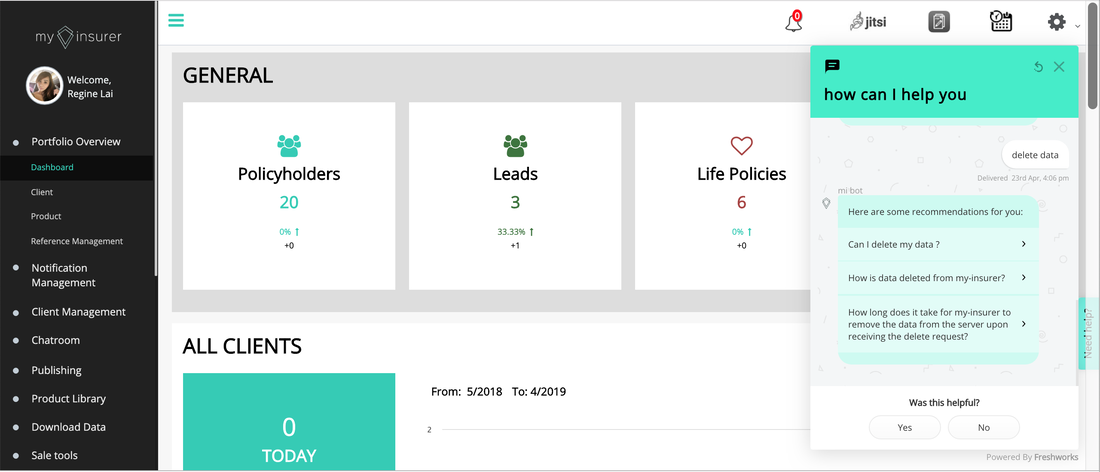

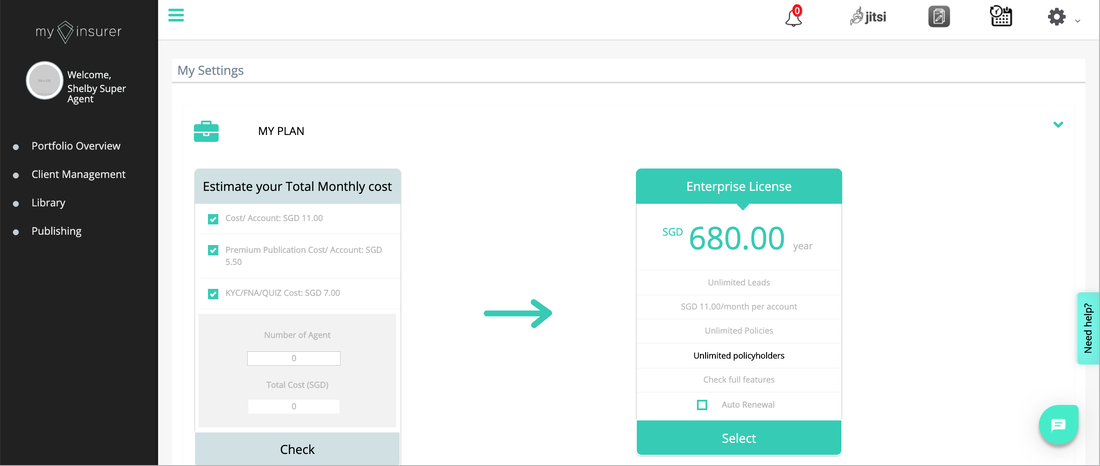

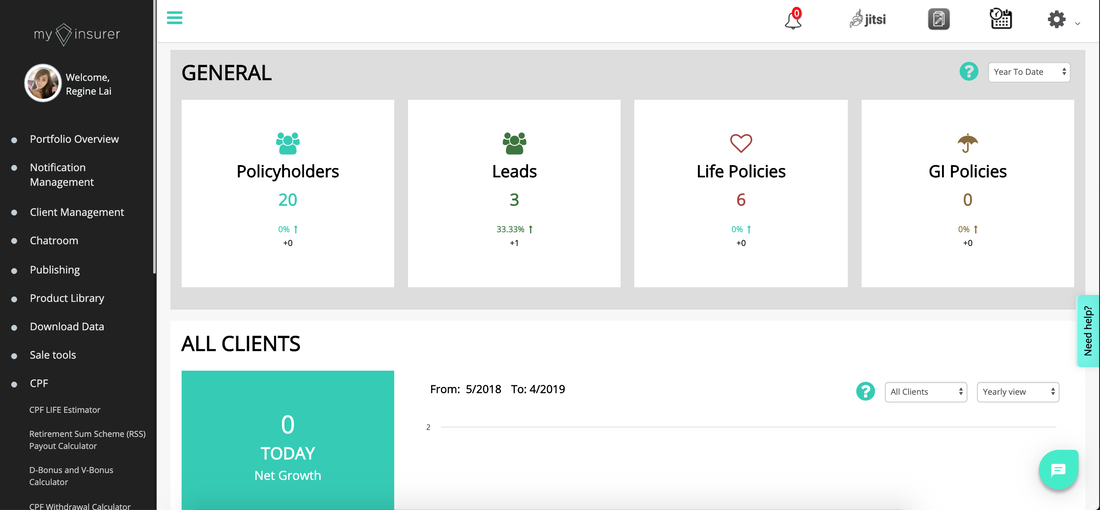

Another incredible milestone for my-insurer! Less than few months ago, my-insurer reported hitting over 10,000 policyholders and set ourselves what we thought was an ambitious goal of reaching a new milestone of 20,000 policyholders in 200 days. We are now pleased to report that we’ve done it in a fraction of that time and acquired an additional 10,000 policyholders in under 4 months! We’ve been working tirelessly on bringing more creative and relevant developments, and getting our users more engaged, which ultimately should be good news for my-insurer as a whole. As a result, a much higher proportion of the intermediaries, policyholders and leads are more involved. These are some of the developments we have embarked on since the beginning of the year: April 2019 Release

March 2019 Release

February 2019 Release

January 2019 Release

After the blockchain last week, today we’re diving in the Insurtech industry. Matthias de Ferrières, founder and CEO of the Stark group tells us how he started his companies and what it means for him to be an entrepreneur. Matthias, tell us more about yourself? I founded my first company when I was 16. It was a community of Lego fans and we were organizing events on weekends. It was really fun and I learned a lot! But I sold it after a year to go back to my studies. After that I worked for Arthur Andersen for about a year and then I wanted to learn english so I decided to move to Australia. I did several jobs there and I finally got a lawyer degree. I then moved to Singapore to work for Axa. I started as a intern, and I ended-up as their CMO when I left. What are you doing now? So in 2013, digital was starting to boom and we had a product to acquire customers online. I decided to take it and built a company around it, this is how Stark Group started. Today the group has 3 businesses:The company is mandated by banks or insurers to design their products, from the customer journey to the pricing, etc.). Most insurers today are focused on compliance, legal and risk, not really the product design itself sor we’re filling this gap.In partnerships with DBS we’ve built the first price comparison engine for motor insuranceThis one works extremely well and takes most of my focus at the moment. It is a marketing platform for insurance intermediaries What does it mean for you to be an entrepreneur?

The challenge is that the insurance business is not interesting or sexy for anybody. To me this is a great opportunity as an entrepreneur. I’m convinced that you need experience anyways, whatever the business you’re in. Entrepreneurship is really about knowing your industry inside out and understanding its needs and risks. Today my company works because I spent 15 years working like crazy in a company in this domain. You need 3 things:

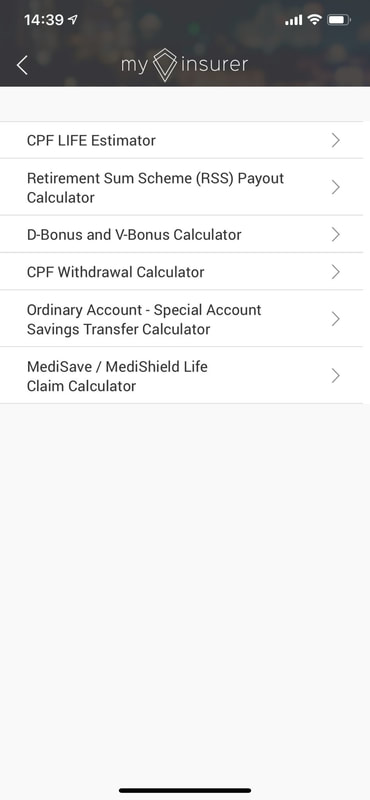

What are you objectives in the coming months? Today I’m very focused on MyInsurer. I have always bootstrapped my businesses and Stark Group has invested SGD400K in MyInsurer, but now is the time for us to raise more funds and hire different types of profiles. I am very pragmatic: I know I am very good at knowing which products to build and how to sell them, but I need the right profiles to help use on other aspects. Our plan is to raise funds in September to be ready to deploy later in the year. Your CPF account and calculator is now available on my-insurer both for intermediaries and policyholders to determine the following:

For INTERMEDIARIES For POLICYHOLDERS

|

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |