|

My-Insurer Triumphs at The Digital Insurer Awards 2024: A Celebration of Innovation, Compliance, and Transformation In a remarkable display of industry leadership, My-Insurer has clinched the top spot at the esteemed The Digital Insurer (TDI) Awards 2024. Now in its ninth year, this annual event is a testament to the relentless pursuit of innovation and excellence in the digital insurance sector, recognizing and celebrating companies that are reshaping the insurance landscape through technology. The TDI Awards 2024 will shine a spotlight on the most innovative InsurTechs across Asia Pacific, EMEA, and the Americas. This platform empowers InsurTech entrepreneurs to present their solutions that are accelerating the digital transformation of insurance, effectively addressing industry challenges and capitalizing on new market opportunities. The regional winners will then compete in the Global InsurTech Innovation Awards. To participate in the InsurTech Innovation Awards, InsurTechs from any category can apply, provided they have a launched business (seed stage or beyond) and can demonstrate tangible evidence of digital innovation success in collaboration with one or more insurers over the past 12 months. Entries must be submitted through the TDI website by the specified regional deadlines. The submission should include a PowerPoint presentation of no more than 12 slides and a video pitch of not more than 60 seconds. Regional finalists will attend a virtual regional awards event, and all award entries will be published online to give all applicants exposure for their innovations. Regional winners will be announced and will proceed to compete in the Global InsurTech Innovation Award later in the year. The criteria for winning include receiving exposure through TDI for all qualifying applications. For the regional awards, a panel of industry experts will shortlist 4-6 InsurTechs for live presentations at the regional awards event. TDI members will then vote for the regional winner. Each regional winner will compete for the Global InsurTech Innovation Award in December 2024, which will again be determined by a vote from TDI members. My-Insurer's White Label Digital Ecosystem, which offers a unique blend of affordability, immediacy, and compliance, has set new standards in the industry. This solution enables clients to build their brand distinctively, without incurring high costs or waiting for extended periods. Moreover, it ensures that all operations adhere to the stringent compliance standards of the insurance industry. Matthias de Ferrieres, CEO and Founder stated that "The victory of My-Insurer at the TDI Awards 2024 underscores the company's relentless pursuit of innovation and its unwavering commitment to compliance. It serves as a testament to the company's dedication to providing its clients with cutting-edge solutions that not only differentiate their brands but also ensure they operate within the regulatory framework." As we celebrate My-Insurer's triumph, we look forward to seeing how this recognition will further fuel their innovation and drive in the digital insurance space. With My-Insurer leading the charge, the future of digital insurance indeed looks promising. My-Insurer has achieved a notable position at The Digital Insurer (TDI) Awards 2024. This annual event, now in its ninth year, acknowledges and celebrates companies that are making significant strides in the digital insurance sector by leveraging technology.

The TDI Awards 2024 will highlight notable InsurTechs across Asia Pacific, EMEA, and the Americas. This platform allows InsurTech entrepreneurs to present their solutions that are contributing to the digital transformation of insurance, addressing industry challenges, and leveraging new market opportunities. The regional winners will then compete in the Global InsurTech Innovation Awards. InsurTechs from any category can apply for the InsurTech Innovation Awards if they have a launched business (seed stage or beyond) and can demonstrate digital innovation success in collaboration with one or more insurers over the past 12 months. Entries must be submitted through the TDI website by the specified regional deadlines. The submission should include a PowerPoint presentation of no more than 12 slides and a video pitch of not more than 60 seconds. Regional finalists will attend a virtual regional awards event, and all award entries will be published online to give all applicants exposure for their innovations. Regional winners will be announced and will proceed to compete in the Global InsurTech Innovation Award later in the year. The criteria for winning include receiving exposure through TDI for all qualifying applications. For the regional awards, a panel of industry experts will shortlist 4-6 InsurTechs for live presentations at the regional awards event. TDI members will then vote for the regional winner. Each regional winner will compete for the Global InsurTech Innovation Award in December 2024, which will again be determined by a vote from TDI members. Matthias de Ferrieres, described My-Insurer as a White Label Digital Ecosystem that offers a blend of affordability, immediacy, and compliance, setting new standards in the industry. This solution enables clients to build their brand distinctively, without incurring high costs or waiting for extended periods. Moreover, it ensures that all operations adhere to the compliance standards of the insurance industry. My-Insurer's achievement at the TDI Awards 2024 underscores the company's pursuit of innovation and its commitment to compliance. It serves as a testament to the company's dedication to providing its clients with solutions that differentiate their brands and ensure they operate within the regulatory framework. As we celebrate My-Insurer's success, we look forward to seeing how this recognition will further fuel their innovation and drive in the digital insurance space. With My-Insurer leading the charge, the future of digital insurance looks promising. My-Insurer Expands F&B Partnerships to Enhance Member Wellness of WELLNEX and other WHITE LABELS7/17/2024

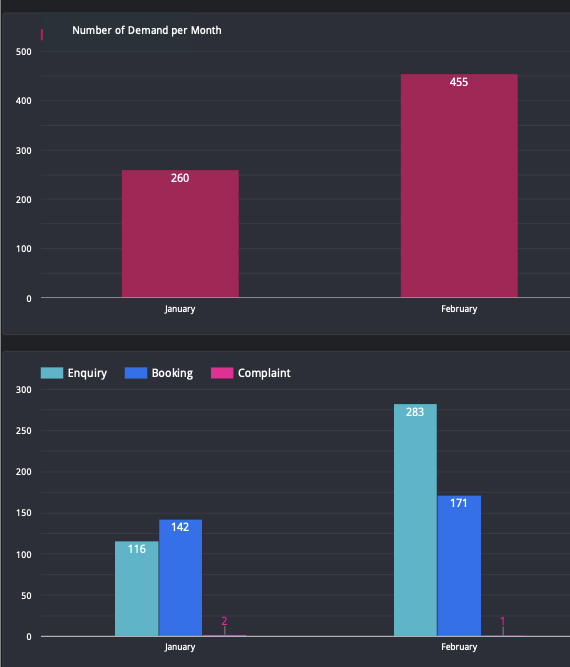

My-Insurer is now known as a prominent player in the health and wellness industry. It is making significant strides in expanding its partnerships with Food and Beverage (F&B) providers. This strategic move aims to enhance the services offered to its growing member base. By collaborating with a diverse range of F&B partners, Wellnex is not only broadening the variety of options available to its members but also ensuring that these offerings meet the highest standards of quality and nutritional value. The drive to recruit new F&B partners is part of Wellnex's larger mission to promote a healthier lifestyle among its members. Recognizing the pivotal role that diet plays in overall wellness, Wellnex is focused on integrating nutritious and delicious food options into its service offerings. This initiative is designed to provide members with convenient access to meals that support their health goals, whether they are looking to manage weight, boost energy, or simply enjoy wholesome, tasty food. Wellnex's efforts in securing these partnerships involve rigorous selection processes to ensure that each F&B partner aligns with the company’s commitment to quality and health. By collaborating with reputable restaurants, cafes, and food suppliers, Wellnex guarantees that its members can trust the nutritional value and safety of the food provided. Additionally, Wellnex is leveraging these partnerships to offer exclusive deals and discounts to its members, making healthy eating more accessible and affordable. This approach not only incentivizes members to make healthier food choices but also supports local F&B businesses, fostering a community-oriented ecosystem. Matthias de Ferrieres, CEO of My-Insurer stated "as Wellnex continues to grow its network of F&B partners, it remains dedicated to its core mission of enhancing the well-being of its members. This ongoing expansion is a testament to Wellnex’s commitment to innovation and excellence in the health and wellness sector." Matthias de Ferrieres added "By continuously improving and diversifying its offerings, Wellnex is ensuring that its members receive the best possible support on their wellness journeys." Wellnex, a key player in the health and wellness industry, is making significant progress in expanding its partnerships with Food and Beverage (F&B) providers. This strategic initiative aims to elevate the services offered to its ever-growing member base. By joining forces with a diverse array of F&B partners, Wellnex is not only increasing the variety of options available to its members but also ensuring these offerings meet the highest standards of quality and nutritional value. The push to recruit new F&B partners aligns with Wellnex's broader mission to promote healthier lifestyles among its members. Recognizing the critical role diet plays in overall wellness, Wellnex is focused on integrating nutritious and delicious food options into its services. This initiative provides members with convenient access to meals that support their health goals, whether they're looking to manage weight, boost energy, or simply enjoy wholesome, tasty food. Wellnex's efforts to secure these partnerships involve rigorous selection processes to ensure that each F&B partner aligns with the company’s commitment to quality and health. By collaborating with reputable restaurants, cafes, and food suppliers, Wellnex ensures that its members can trust the nutritional value and safety of the food provided. Moreover, Wellnex leverages these partnerships to offer exclusive deals and discounts to its members, making healthy eating more accessible and affordable. This approach not only incentivizes members to make healthier food choices but also supports local F&B businesses, fostering a community-oriented ecosystem. As Wellnex continues to expand its network of F&B partners, it remains dedicated to its core mission of enhancing member well-being. This ongoing expansion underscores Wellnex’s commitment to innovation and excellence in the health and wellness sector. By continuously improving and diversifying its offerings, Wellnex ensures that its members receive the best possible support on their wellness journeys. In today’s fast-paced digital world, businesses need to find innovative ways to connect with and retain their customers. Wellnex offers a comprehensive suite of tools designed to help businesses build and grow their communities effectively. Here’s a breakdown of the key features that make Wellnex a compelling choice for businesses looking to nurture and incentivize their members. The foundation of any successful business is a robust lead generation strategy. Wellnex provides an unlimited lead generation tool that works both offline and online. This ensures that businesses can capture and convert potential customers from various channels, creating a steady stream of new prospects. A membership card is more than just a piece of plastic; it’s a powerful tool for customer engagement. Wellnex offers membership cards with unlimited types and designs, coupled with dynamic tracking capabilities. This allows businesses to customize their membership programs to suit their unique needs and track member activities in real-time. Loyal customers are the backbone of any successful business. Wellnex ’s loyalty program is ready to offer exclusive benefits that keep customers coming back. By providing rewards and incentives, businesses can foster a sense of loyalty and encourage repeat business, ultimately boosting their bottom line. In the digital age, QR codes have become an essential tool for seamless interactions. Wellnex provides unlimited QR code makers, enabling businesses to create and distribute QR codes effortlessly. These codes can be used for a variety of purposes, such as directing customers to special promotions, gathering feedback, or facilitating easy check-ins. Effective communication is key to maintaining a strong relationship with customers. Wellnex supports unlimited mass mail, notifications of news, and promotions on the app, along with social network sharing. This multi-channel approach ensures that businesses can reach their members wherever they are, keeping them informed and engaged. Word-of-mouth remains one of the most effective marketing strategies. Wellnex ’s referral module allows businesses to leverage their existing customer base to attract new members. By incentivizing current members to refer friends and family, businesses can expand their reach and grow their community organically.

Wellnex provides a robust platform for businesses looking to build and grow their communities. With tools ranging from lead generation and membership cards to loyalty programs and multi-channel publications, Wellnex equips businesses with everything they need to nurture and incentivize their members effectively. By choosing Wellnex, businesses can create a thriving, engaged community that supports long-term success. For more information, visit [Wellnex Singapore](http://www.wellnex-singapore.com). My-Insurer to receive the highest distinction from The Digital Insurer: APAC Innovation Award7/5/2024

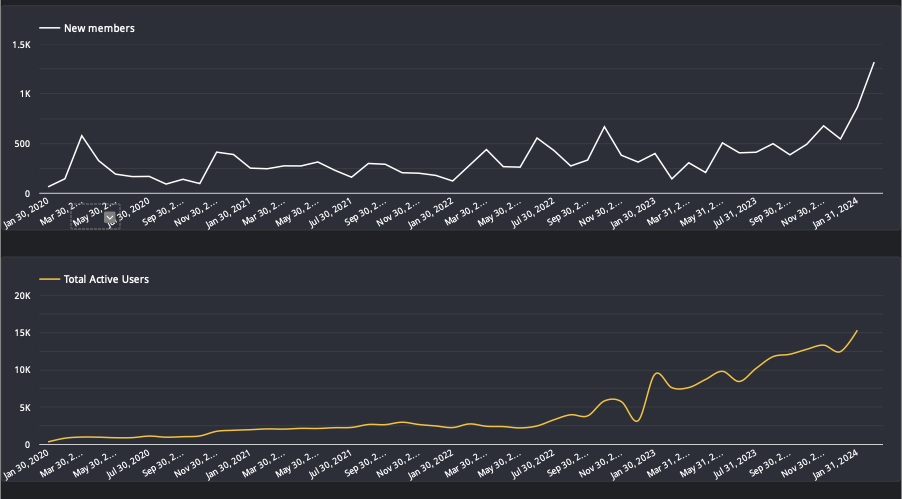

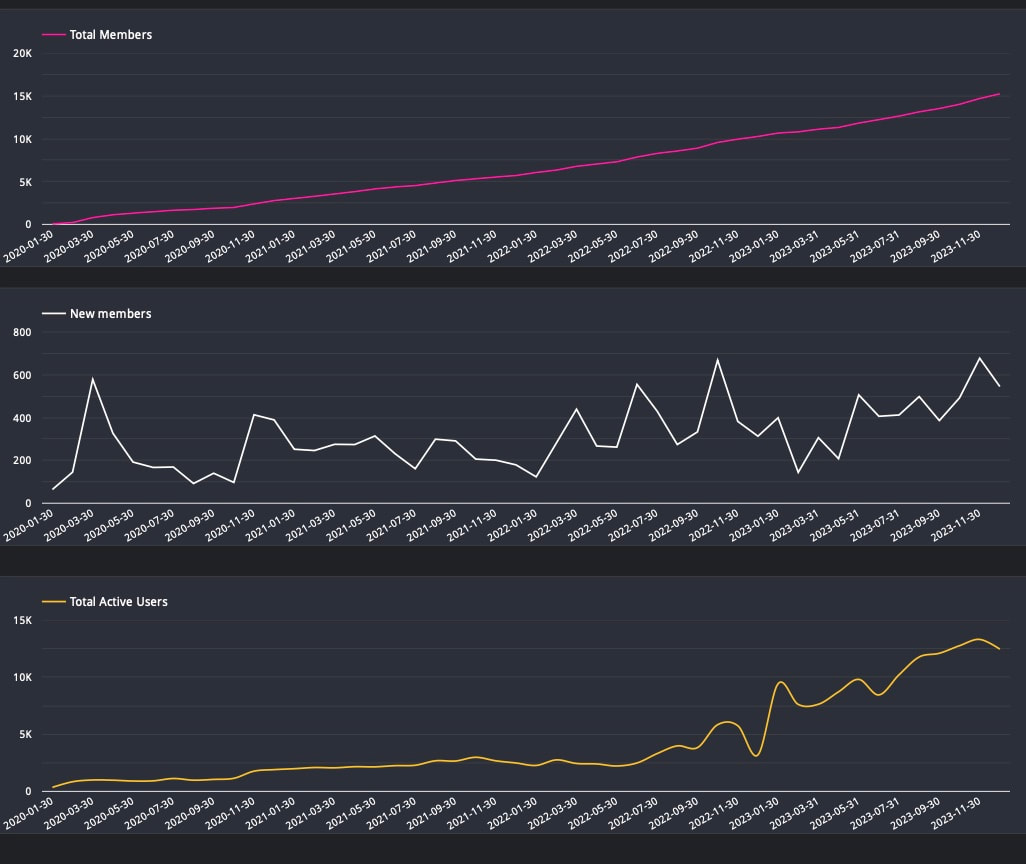

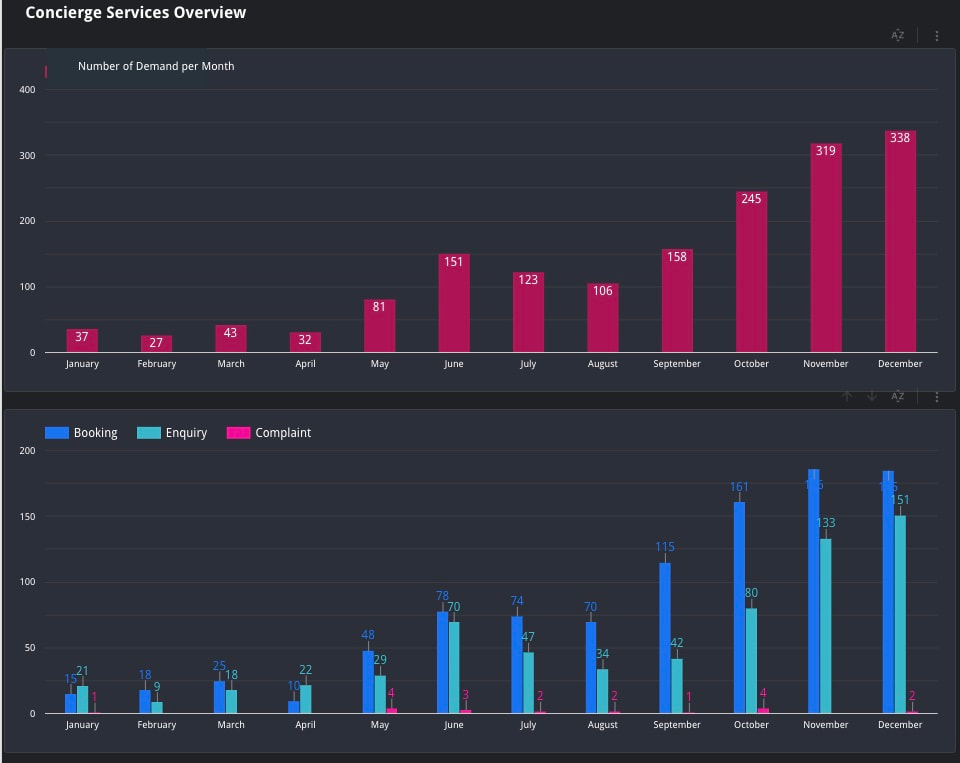

Breaking news! 🎉 Congratulations to my-insurer for winning the APAC Region’s InsurTech Innovation Award for 2024 at The World’s Digital Insurance Awards! Huge kudos to the team for the well-deserved recognition! We’ll be posting more details on this, and more updates from the APAC Finals in the coming days, so please stay tuned! "And it is a win! Completely unexpected. Hundreds of applications, 6 finalists for the Insurtech segment...1,000 over attendees that voted. Finalists like my-insurer and WELLNEX could not vote. Happy to have competed against known and reknown startups like: PolicyStreet Finology Plum ZA Technologies Exegesis Infotech (I) Private Limited Across Assist and more!" Said Matthias de Ferrieres, CEO and Founder of My-Insurer. My-Insurer Pte Ltd confirmed that is revolutionizing the way insurance intermediaries build and enhance their brand. This digital platform is designed to help intermediaries stand out in a crowded market by providing a unique, affordable, and fast way to offer added value to their leads, customers, and employees, all under their own brand name. At the heart of My-Insurer Pte Ltd ’s offerings is a fully customizable app. This app, integrated with SingPass and certified with the Data Protection TrustMark by IMDA, is designed to provide users with a seamless and secure experience. The app offers a free concierge service that provides affordable and reliable health, lifestyle, and home services. These services are tailored to meet the diverse needs of users, making the app both relevant and engaging. Additionally, the app includes multiple opt-in/opt-out functionalities, allowing users to customize their experience according to their preferences. But My-Insurer doesn't stop at just offering a customizable app. The platform also includes a multi-layer personalized CRM. This CRM is a powerful tool that helps intermediaries generate leads, launch targeted marketing campaigns, and monitor their portfolios dynamically. It provides a comprehensive overview of client interactions and helps intermediaries stay on top of their client’s needs. The CRM also includes opt-in/opt-out features, ensuring that the services remain pertinent and valuable to clients. One of the standout features of My-Insurer is its focus on compliance and data protection. The integration with SingPass ensures that user authentication is secure and reliable. Moreover, the platform's certification with the Data Protection TrustMark by IMDA underscores its commitment to maintaining high standards of data protection and privacy. By leveraging My-Insurer, insurance intermediaries can significantly raise their value perception in the eyes of their clients. The platform allows them to offer a suite of added services that are delivered through their own brand identity. This not only enhances the customer experience but also builds trust and loyalty. My-Insurer, is a comprehensive digital ecosystem that empowers insurance intermediaries to enhance their brand and service offerings. With its customizable app, personalized CRM, and robust focus on compliance, My-Insurer, provides a user-friendly and secure platform that meets the evolving needs of insurance intermediaries and their clients. By adopting My-Insurer, intermediaries can stay ahead of the competition, offer better services, and build stronger relationships with their clients. My-Insurer Pte Ltd is thrilled to announce the launch of AppForDummies.com, a revolutionary no-code platform that simplifies app design and deployment. Inspired by the renowned "For Dummies" franchise, AppForDummies.com aims to make app creation easy, accessible, and affordable for everyone, regardless of their coding expertise. AppForDummies.com is a fully-owned platform by My-Insurer Pte Ltd, a company known for its commitment to innovation and accessibility in the tech industry. With the launch of AppForDummies.com, the company takes another significant step towards democratizing app development. "AppForDummies.com is designed to empower businesses, stores, and communities to turn their ideas into apps without the need for coding expertise," said Matthias de Ferrieres, the founder of AppForDummies.com. The native apps built with AppForDummies.com come with endless design, color schemes and features. AppForDummies priority is to facilitate the app deployment for you to focus on what is critical: your business. Get a view of some apps that have been deployed through AppForDummies, and remember that is just an example. "We believe that app creation should be easy, accessible, and affordable for everyone, and that's exactly what AppForDummies.com offers." AppForDummies.com offers a user-friendly interface that guides users through the app creation process, from design to deployment. The platform provides a wide range of customizable templates, drag-and-drop features, and intuitive tools that make app creation a breeze. One of the key features of AppForDummies.com is its affordability. The platform aims to offer an affordable, easy-to-deploy app solution, making it an ideal choice for small businesses, startups, and individuals looking to create their own apps without breaking the bank. "We're excited to see how AppForDummies.com will revolutionize the app development industry," said Matthias de Ferrieres. "We believe that our platform will open up new opportunities for businesses and individuals, enabling them to reach their audience in a more effective and engaging way." AppForDummies.com is now live and ready to help you turn your app idea into reality. Visit www.AppForDummies.com to start your app creation journey today. About AppForDummies.com AppForDummies.com is a no-code app development platform that simplifies app design and deployment. Inspired by the "For Dummies" franchise, the platform aims to make app creation easy, accessible, and affordable for everyone. AppForDummies.com is a fully-owned platform by My-Insurer Pte Ltd, a company committed to innovation and accessibility in the tech industry. Wellnex, the pioneering concierge membership service dedicated to healthcare, lifestyle, wellness, and home services, owned by My-Insurer Pte Ltd, proudly announces a momentous achievement with an unprecedented surge in membership. In just one month, Wellnex welcomed over 900 new members, setting a new record for its rapid growth trajectory. The exponential increase in membership is a testament to Wellnex's unwavering commitment to providing exceptional service and personalized care to its members. With a comprehensive suite of concierge services, Wellnex caters to the diverse needs of its members, offering a seamless experience across healthcare, lifestyle enhancement, wellness programs, and household management. "We are thrilled to witness such an overwhelming response from individuals seeking premium concierge services tailored to their unique lifestyles," said Matthias de Ferrieres, CEO of Wellnex. "The record-breaking influx of new members is a testament to the value proposition and unparalleled convenience that Wellnex offers." In addition to the remarkable increase in new memberships, Wellnex boasts a total active membership exceeding expectations, with over 200 concierge services available to its members. From coordinating healthcare appointments to organizing bespoke wellness experiences, Wellnex ensures that members have access to a wide array of services designed to enhance their overall well-being and lifestyle. "We are dedicated to continuously expanding and enhancing our offerings to meet the evolving needs of our members," added Matthias de Ferrieres. "This milestone reinforces our commitment to redefining convenience and setting new standards of excellence in concierge services." As Wellnex continues to innovate and grow, it remains steadfast in its mission to empower individuals to live their best lives by providing unparalleled support and assistance across all facets of health, wellness, and lifestyle. About Wellnex: Wellnex is a leading concierge membership service dedicated to healthcare, lifestyle, wellness, and home services. With a commitment to personalized care and exceptional service, Wellnex offers a comprehensive suite of concierge services designed to enhance the well-being and convenience of its members. From healthcare coordination to lifestyle enhancements, Wellnex delivers unparalleled support and assistance, allowing members to live their best lives with ease and convenience. The exponential increase in membership is a testament to Wellnex's unwavering commitment to providing exceptional service and personalized care to its members. With a comprehensive suite of concierge services, Wellnex caters to the diverse needs of its members, offering a seamless experience across healthcare, lifestyle enhancement, wellness programs, and household management.

"We are thrilled to witness such an overwhelming response from individuals seeking premium concierge services tailored to their unique lifestyles," said Matthias de Ferrieres, Founder and CEO of Wellnex. "The record-breaking influx of new members is a testament to the value proposition and unparalleled convenience that Wellnex offers." In addition to the remarkable increase in new memberships, Wellnex boasts a total active membership exceeding expectations, with over 400 concierge services available to its members. From coordinating healthcare appointments to organizing bespoke wellness experiences, Wellnex ensures that members have access to a wide array of services designed to enhance their overall well-being and lifestyle. "We are dedicated to continuously expanding and enhancing our offerings to meet the evolving needs of our members," added Matthias de Ferrieres. "This milestone reinforces our commitment to redefining convenience and setting new standards of excellence in concierge services." As Wellnex continues to innovate and grow, it remains steadfast in its mission to empower individuals to live their best lives by providing unparalleled support and assistance across all facets of health, wellness, and lifestyle. My-Insurer, the Singapore base industry-leading White Label Digital Ecosystem, dedicated to empowering firms and SMEs through digitization, proudly unveils its Full-Year Review for 2023.

The year was marked by extraordinary growth, strategic expansions, and innovative initiatives, setting the stage for a transformative journey in the year ahead. My-Insurer confirms tha its stands at the forefront of White Label Digital Ecosystems, catering to two distinct segments:

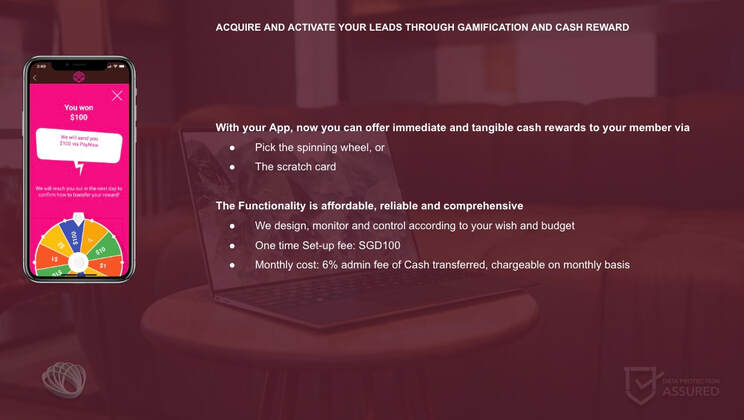

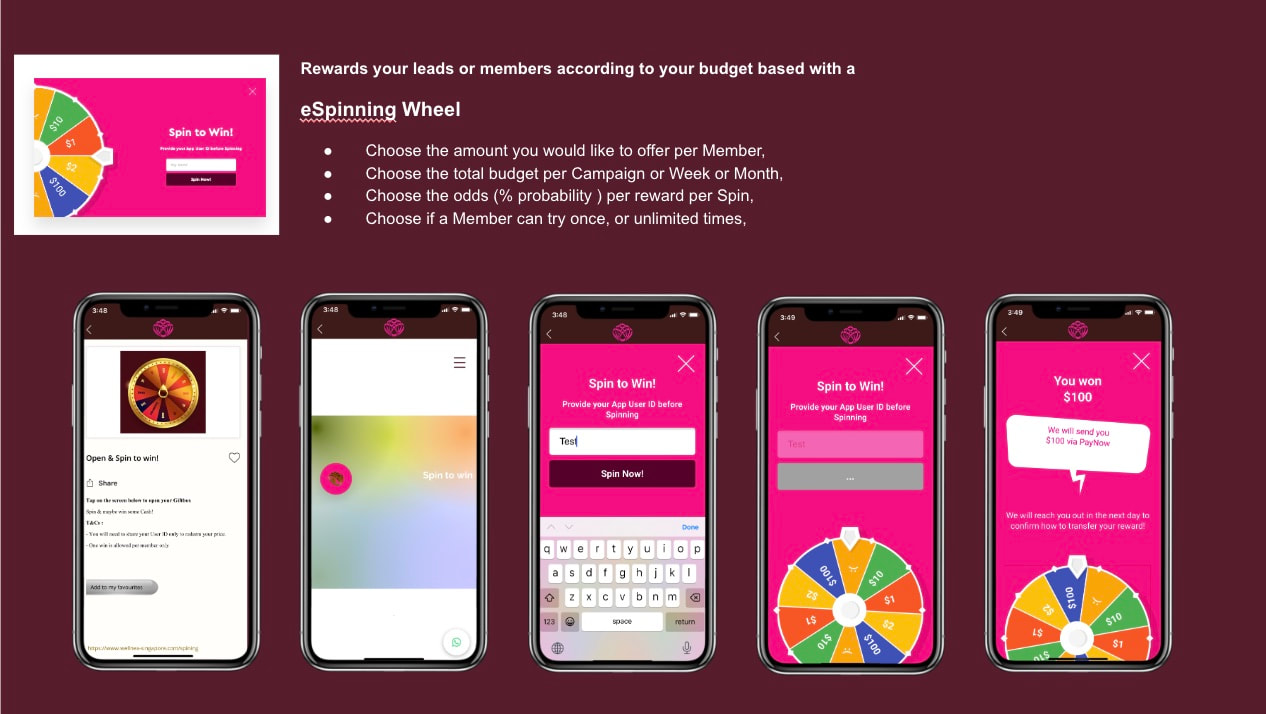

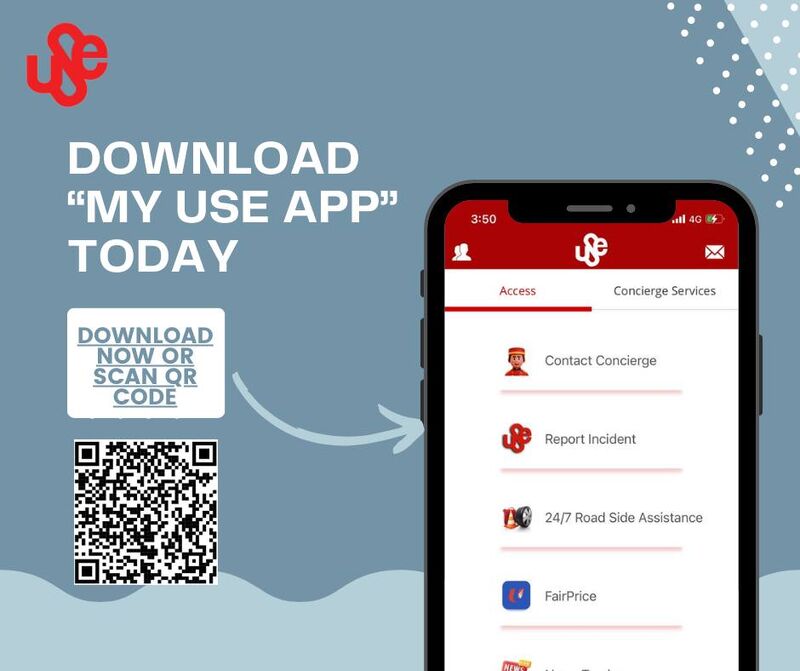

Overall Growth and Financial Success: In 2023, Wellnex achieved a remarkable +132% increase in new white labels and an impressive +101% rise in recurring revenue, solidifying its market position and financial resilience. Portfolio Expansion and Market Penetration: The company expanded its portfolio to include 39 White Labels and an extensive network of 2,558 Agents serving 46,444 Members. Additionally, collaborations with 370 Clinics & Partners further amplified its market reach. 2024 Forecast and Strategic Initiatives: Looking ahead, My-Insurer aims to soar higher in 2024 with an anticipated average monthly recurring revenue to again double by year-end. Strategic endeavors involve exploring global deployment through strategic partnerships in ASEAN countries and introducing groundbreaking concepts such as Travel insurance solutions and corporate-focused private social networks. "We are immensely proud of the exceptional growth achieved in 2023 and remain dedicated to redefining digital ecosystems in 2024," said Matthias de Ferrieres, CEO of My-Insurer. "The accomplishments of 2023 are a testament to the unwavering dedication and hard work of the entire My-Insurer team. The company looks forward to a prosperous and transformative year ahead." In a bid to revolutionize client engagement and satisfaction, My-Insurer is proud to announce the launch of an exciting functionality: Immediate Rewards through lucky draw games. This new feature aims to provide a more interactive and enjoyable experience for clients, while also offering them instant gratification. At the heart of this new functionality are two engaging games: the Scratch Card and the Steering Wheel. Each game is designed to offer a distinct interactive experience, catering to different user preferences The Scratch Card game provides a tangible and gratifying experience for clients. Users can reveal their rewards by scratching the virtual card, creating an element of excitement and anticipation. This hands-on approach adds a layer of satisfaction to the process, making it a highly enjoyable way to interact with My-Insurer. For clients seeking a more dynamic experience, the Steering Wheel game is the perfect choice. This game introduces an element of chance and unpredictability, as users spin the wheel to unveil their rewards. The thrill of watching the wheel spin and land on a prize adds an exciting dimension to the interaction. Offering immediate rewards through lucky draws is a powerful strategy to engage and incentivize clients. It provides an instant gratification that reinforces the value of their interaction with My-Insurer. This innovative approach not only strengthens client relationships but also sets My-Insurer apart in a competitive market. One of the key strengths of this new functionality is its ability to cater to different client preferences. Whether a client enjoys the tactile experience of scratching a card or the anticipation of spinning a wheel, My-Insurer ensures that each interaction is personalized and memorable. Matthias de Ferrieres, CEO of My-Insurer confirmed that "the introduction of Immediate Rewards through lucky draw games marks a significant milestone in My-Insurer's commitment to enhancing client experiences. The Scratch Card and Steering Wheel games will offer dynamic and engaging ways for our clients to interact even more with their members." Matthias de Ferrieres added that "ultimately strengthening client relationships will solidify My-Insurer's position as a leader in the Insurtech industry." My-Insurer Pte Ltd is proud to announce its partnership with the Union of Security Employees (USE), a prominent affiliate of the National Trades Union Congress (NTUC) representing over 22,000 members engaged in various security and security-related services. Established in 1978, USE has been a stalwart advocate for the welfare and rights of security professionals. With this collaboration, My-Insurer Pte Ltd introduces the innovative "My USE App ", a comprehensive platform designed to streamline reporting mechanisms for grievances while offering an array of additional benefits. "We are excited to welcome the Union of Security Employees as a valued client," said Matthias de Ferrieres, CEO of My-Insurer Pte Ltd. "The introduction of the My USE app not only simplifies the reporting process but also integrates features that directly contribute to the well-being and satisfaction of USE Union members." Key Features of the My USE App Include:

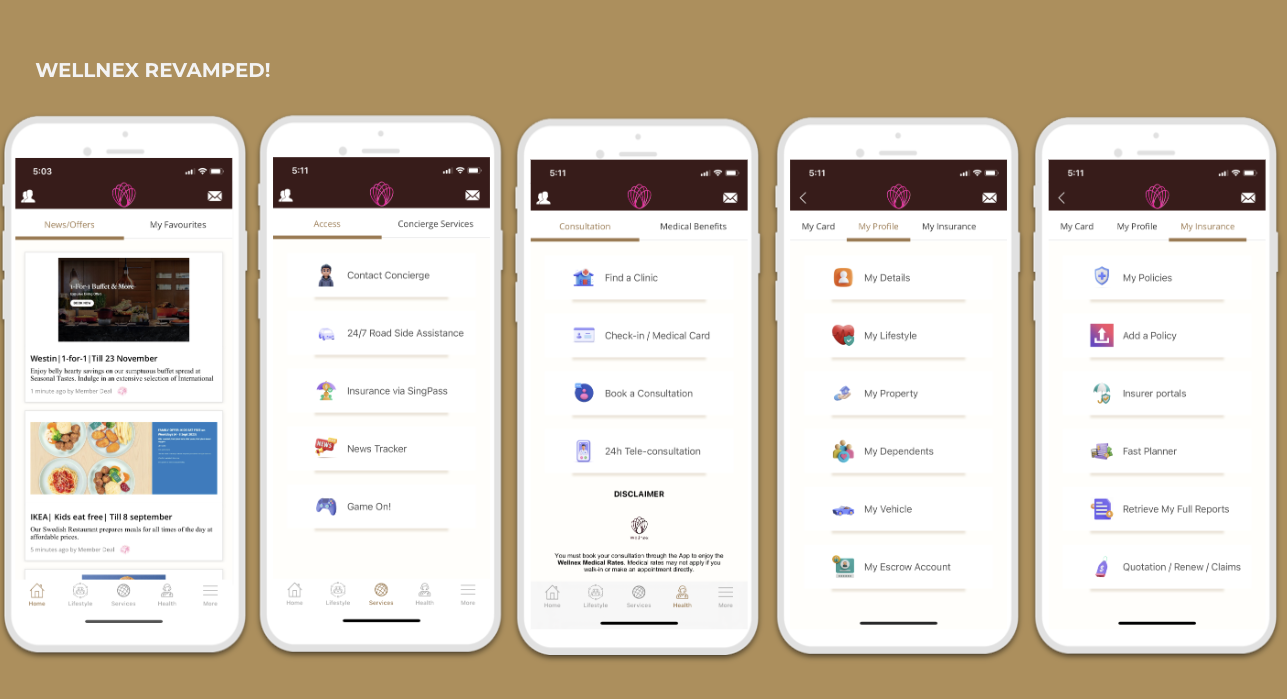

My-Insurer is pleased to announce a significant transformation of the Wellnex application, a popular platform for healthcare, lifestyle, wellness, and home services. At Wellnex, we're always working to make things even better for you, and we're thrilled to share these exciting updates. This upgrade represents a noteworthy advancement in the journey toward achieving a healthier and more balanced life as efficient as possible.

Notable Enhancements Include:

Matthias de Ferrieres, CEO of My-Insurer thinks these big improvements will make your experience better and show how dedicated we are to providing easy to understand top-notch healthcare, lifestyle, wellness, and home services. As you start using the improved Wellnex, we invite you to discover all the great things it offers. Our main goal is to help you live a healthier and more balanced life, and we're here to support you every step of the way. These icons will also be made available to all our White label partners that wishes to have a 2.0 generation app. |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |