|

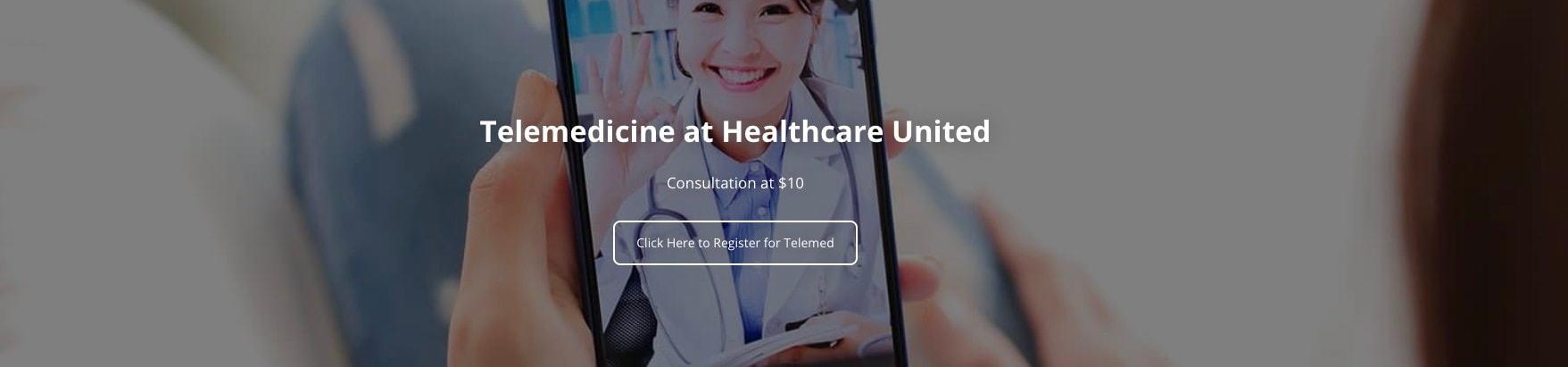

My-insurer, is proud to launch its new medical teleconsultation functionality at $10 only per consultation. Since last year, in partnership with ManaDr, My-insurer was offering 24/7 access for $15 only and provided to its members with easy and affordable access to healthcare services. Our new service is not available 24/7 but 7 days a week with another Partner Healthcare United. Healthcare United is a Singapore family Clinic based in Toa Payoh . The aim to transform family medicine and bring you a brand new way of managing your health efficiently and cost-effectively by leveraging best-of-breed technologies and personalization of healthcare. At My-insurer, we understand the challenges its members face in accessing healthcare services, especially during the ongoing COVID-19 pandemic. Many members have mobility issues, or simply cannot take time off work or school to visit a healthcare provider. Our teleconsultation functionality solves these challenges by providing patients with a reliable and affordable way to access healthcare services from the comfort of their own homes.

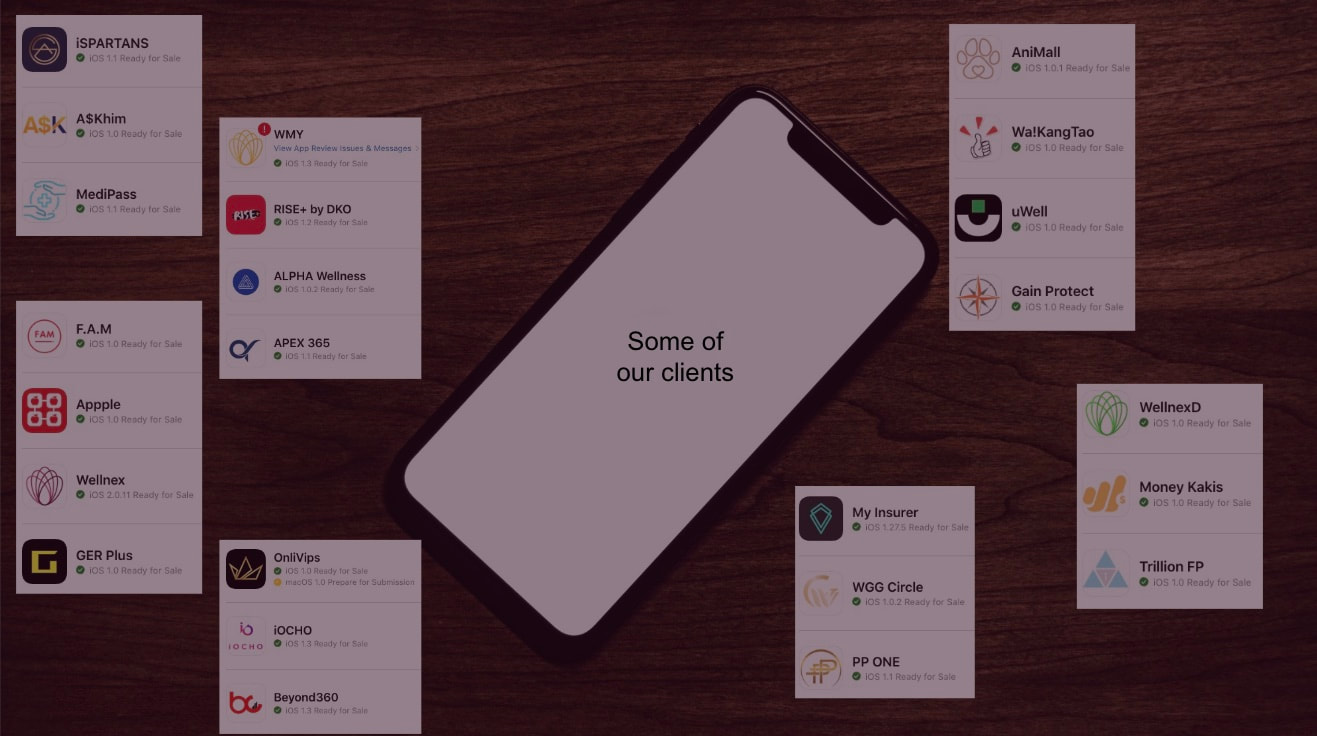

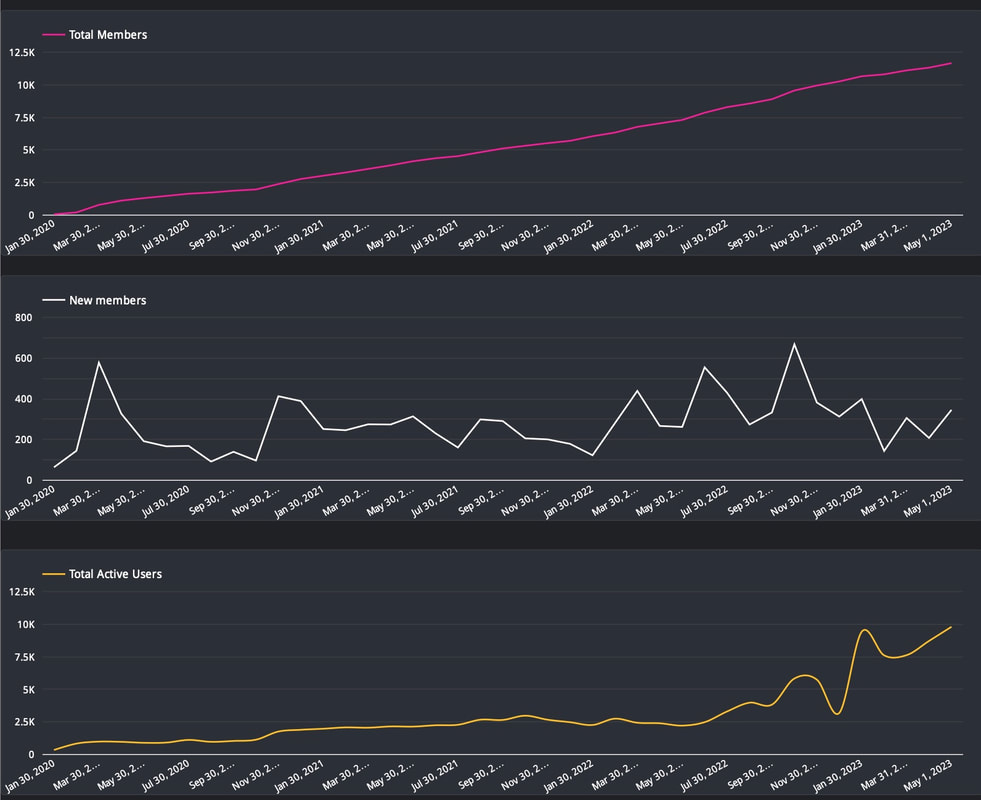

Our medical teleconsultation functionality operates 24/7, making it easier for patients to access healthcare services at any time. You can choose a 24/7 at $15, or book at specific time slot at $10. This service is also available to members who are overseas and are more confortable to discuss with a Singaporean doctor. With this new service, patients can consult with healthcare providers on a range of medical issues, including colds, flu, allergies, skin conditions, and more. Lastly, at My-insurer, we are committed to delivering high-quality healthcare services to our Members. Our medical teleconsultation functionality is designed to provide to them with the same level of care and attention they would receive during an in-person consultation. Our healthcare providers are highly experienced and trained to diagnose and treat a range of medical conditions via telemedicine. The functionality is available to all apps that My-insurer manages including Wellnex. Matthias de Ferrieres, CEO of My-insurer, is thrilled about the launch of the new medical teleconsultation functionality. He believes that this new service is a significant development in the healthcare industry and will help to improve healthcare access and outcomes for many patients. According to Matthias de Ferrieres, "Our new medical teleconsultation functionality is a game-changer for patients who have difficulty accessing healthcare services. We understand that many patients have mobility issues, live in remote areas, or simply cannot take time off work or school to visit a healthcare provider. With this new service, patients can consult with healthcare providers from the comfort of their own homes for just $10." My-Insurer Pte Ltd, a leading insurtech platform that offers White Label Digital Ecosystem dedicated to Advisory Firms has reached a significant milestone with the launch of its 30th client. The company has been providing exceptional and unique services for over a 2 years now, and its latest achievement is a testament to its unwavering commitment to customer satisfaction.

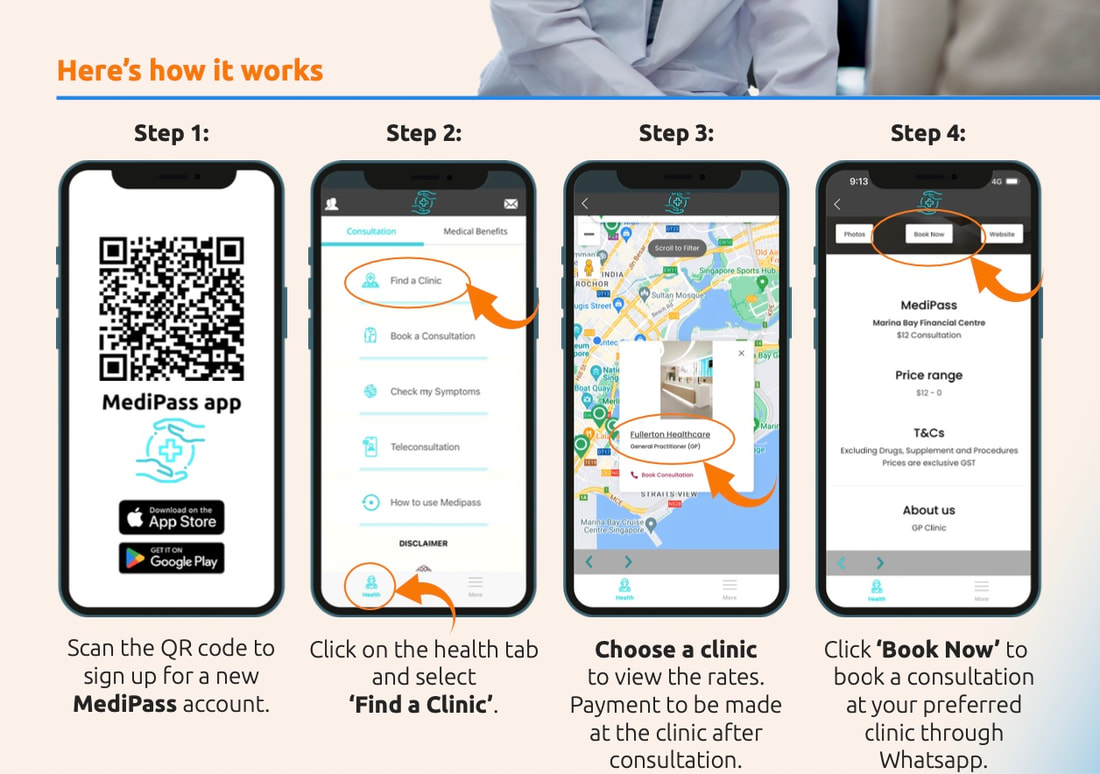

The concierge service is designed to provide personalised and convenient solutions to clients' daily needs while maintaining the brand identity of the client. The My-Insurer team is dedicated to ensuring that clients receive exceptional customer service and that their unique requirements are met. The company's commitment to customer satisfaction has helped it to build a loyal client base and attract new customers. Wellnex, operated by My-Insurer Pte Ltd, provides a fully customized app that includes a free concierge service dedicated to affordable and reliable health, lifestyle, and home services. The platform is SingPass integrated and Data Protection TrustMark certified by IMDA, and it also features an integrated insurance e-wallet and promotes financial advisors' respective campaigns. With over 1,300 financial advisors and 30 white labels, Wellnex's multi-layer CRM facilitates functions such as lead generation, marketing campaigns, 360 insurance reviews, KYCs, financial planning, and dynamic portfolio monitoring. Wellnex is renowned for introducing innovative products and services that cater to the evolving needs of its clients, helping it to maintain its position as a leader in the industry. Today Wellnex serves 1,300 over Financial Advisors from the main insurance companies in Singapore: HSBC, AIA, Prudential, Manulife and Income Insurance. My-Insurer Pte Ltd has partnered with Income Insurance to launch MediPass. MediPass is an exclusive membership program that offers cost-effective and dependable healthcare services to its members through invitation only. The members who are eligible for this program are the policyholders of INCOME Insurance's Domestic Helpers Policy. A QR code will be included in their policy documents which they can use to download the app. With this membership, members will receive complimentary access to a concierge service and a clinic locator that can help them find and book various types of health services, including general and specialist practitioners, teleconsultation, dentists, and health screenings, all at favorable rates. MediPass is a safe and secure platform that fully complies with regulations and offers preferred rates for the mandatory medical check-up that must be done every six months for migrant domestic workers (MDWs). This medical examination is necessary to screen for pregnancy and infectious diseases such as syphilis, HIV, and tuberculosis. With MediPass, domestic helpers and their employers can easily find a suitable and convenient location for the compulsory health screening. They can contact the concierge, who will ask a few simple questions to book an appointment and ensure that the check-up is conducted on time and efficiently.

The CEO of My-insurer, Matthias de Ferrieres, has confirmed this news and emphasized that the platform's key differentiating value proposition is its ability to be easily customized. MediPass has been tailored to meet the specific needs and preferences of INCOME, making it simple to download and compliant with PDPC regulations for data collection. |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |