|

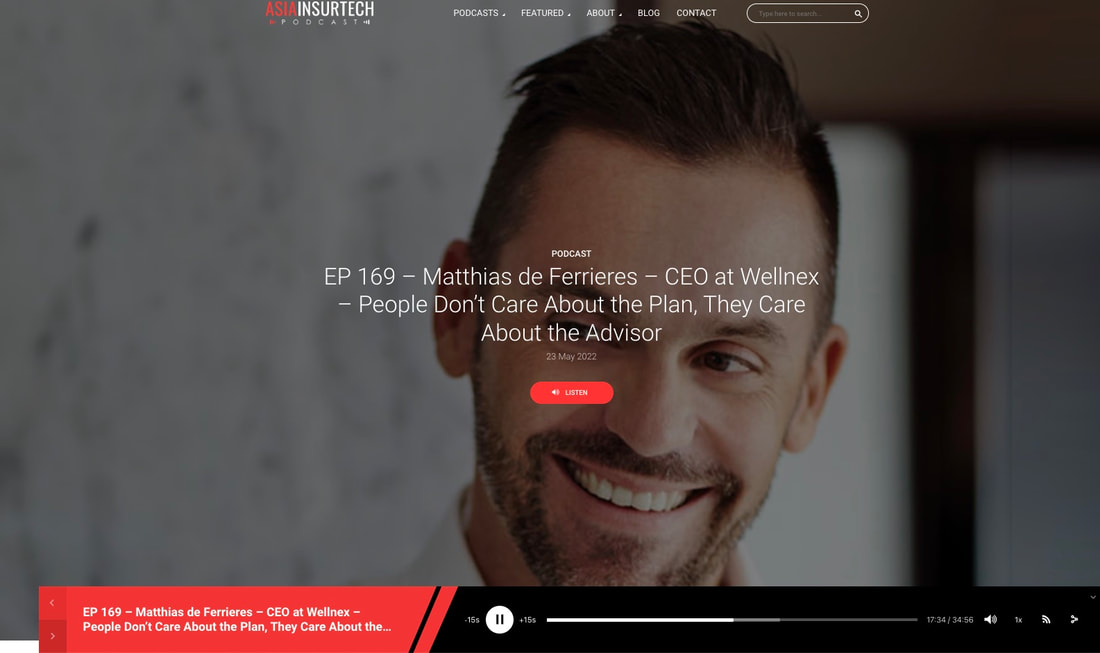

The Asia InsurTech Podcast spoke with Matthias de Ferrieres, the CEO at Wellnex, about the current InsurTech hype and what academic research says about it. Matthias holds a PhD in Entrepreneurial economics and published a dissertation with the title: “The Rise of the Digital Economy: Estimating the Impact of a New Generation of Entrepreneurs as Disruptive Entrants in the Insurance Industry in Singapore”. The gap is not about the insurance per se, but about creating a better value propositions linked to the insurance industry. Matthias de Ferrieres explains in which way Wellnex responds to this value proposition: "Wellnex is like a pre-type of concierge on that by invitation only. Financial advisor are paying me to be able to give that free concierge or to their customer, to their leads, to their clients, okay, to their insured to their policyholder. So financial advisor, again, are my clients. They are paying me a fixed summons per year, to be able to generate leads, and they have a reason to create a leads to invite someone for a webinar or seminar, to push them to go for a screening to get home services. Because it will be free for the customer. And they’re able to collect that as a financial adviser. And the insured is happy, because he has a free membership, where he can get health care service, up to 60% discount, he can get access to concierge that will help them to do to fix their garden, their their air conditioning, I mean any service, you name it. And this will be paid by the financial advisor. So the question now is why it works. Wellnex has a very specific business model. A business model that makes people pay for what they get. The model is not design around commission, charge on transaction or something similar. Talking about Venture Capital and entrepreneurship, Matthias de Ferrieres highlighted that first, not everyone can do what he does, because, he started with the support of AXA. Matthias de Ferrieres justified that he cannot raise money, because of his attitude, his personality which dont fit with the world of Fund Raising.

Also not everyone can can start from scratch because you need a minimum investment and try out. But the beauty of one you don’t have funding is you don’t have the same pressure. By not raising money, Matthias de Ferrieres confirms that he does not have the pressure other may have. For instance, he can can test and learn, he can adjust extremely fast without justifying to anyone else, why he is doing something. Should be attached ot a VC, you need to spend a lot of time and energy to explain to justify why you are doing some things this way and not the other way. In addition most of the times those VCs have the same breed the same way of thinking than any other industry or VCs for the industry. Venture capitalists believe that a good startup is a company that demonstrate tit can acquire more clicks, more members, more time on the app. Revenue is often second. Yet, in insurance such model does not work. Matthias de Ferrieres concluded that the power of Wellnex is the team and the fact that we are independent because it did not raise money and it has a profitable. business. at The Ortus Club - Executive Knowledge Sharing, Matthias de Ferrieres, CEO of My-Insurer Pte Ltd and Wellnex moderated a lunch of Insurance Experts from different Incumbents (Chubb GREAT EASTERN Prudential Assurance Company Singapore QBE Insurance Allianz Insurance Singapore DirectAsia Insurance ) and Insurtechs (Ancileo Igloo ) sponsored by Stripe. People of all ages are now looking at protection and health needs with renewed interest, resulting in rising demand. The future looks filled with promise, but caution is advised for both consumers and providers. Leaders came together at LeVeL33 Pte Ltd in Singapore for a roundtable discussion on ‘The new face of insurance: Navigating uncharted territory’. And the conclusion strikes. The participants did not hesitate to point out that:

Matthias de Ferrieres highlighted that it is always great to be given the opportunity to moderate a table of experts openly, with no restriction and with the opportunity to share frankly what we have in mind, even if it may not please everyone.

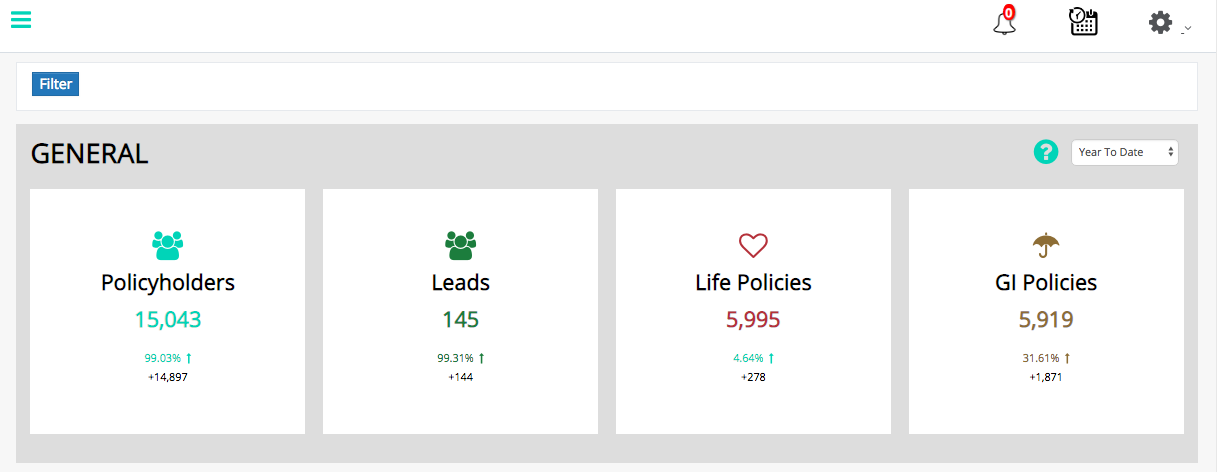

Sebastien Khoo from Wellnex will be sharing on how to boost SALES through referrals! He has a proven sales track record of building long term relationship with clients through service and value adding. This month, Wellnex will also bring in 2 industry experts to share on the importance of client engagement and how simple tweaking of numbers might boost your sales numbers! Sebastien said that creating customer value increases customer satisfaction, increases the customer experience thus increases the overall loyalty". He added that the reverse is also true as a good customer experience will create value for a customer". Sebastien mentioned that it is critical to grow customer loyalty to generate retention and referrals. As such, it is very important to know and support your customers. The better you know your current loyal customers, and learn what products or services they like, the better you can market yourself to new customers. Wellnex is working towards helping Financial Advisors and Property Agents in getting more leads and retaining their clients longer. Thanks to nearly 400 agents, financial planners, financial advisors and other smes, we are proud to announce that we achieved the 15,000 marks!

After 1 year of existence, we are demonstrating that disruption is possible in Insurance without jeopardising the distribution ecosystem customers are expecting to understand and purchase insurance! We will be announcing new features that will speed up our growth in the couple of weeks as well as key partnerships in Singapore and other ASEAN countries. |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |