|

My-insurer partnered with Surer to offer a significant discount to any Surer clients that would like to adopt My-insurer solutions. Any Surer clients will enjoy up 30% discount on the yearly subscription when they are referred by Surer. SURER AND MY-INSURER/WELLNEX PARTNERS TO DELIVER MORE VALUE TO INSURANCE INTERMEDIARIES

Intermediaries spend over 70% of their time on administrative work. Local InsurTech startups have partnered to offer intermediaries a holistic solution on their platforms to help streamline the whole process, from client advising to deal closing, in 10x less time. Surer and My-Insurer/Wellnex have formed a strategic partnership as both startups have a shared vision to empower insurance intermediaries through technology, elevating their value to clients and optimising work processes. Surer is a cloud-based technology solution that helps intermediaries save 95% of their time on product quote sourcing and transact on a deal 10x faster. My-Insurer/Wellnex is a digital platform that allows these intermediaries to analyse their client’s financial needs using AI simulation and to manage their portfolio better. The partnership will see both companies collaborate to upskill each other’s user base via their solutions, through discounted pricing and joint education efforts via channels like newsletters and webinars. “The vision of Surer is to empower insurance intermediaries to be able to work with greater speed and efficiency. The benefits of a supercharged intermediary cannot be understated – they are the cornerstone of the general insurance industry where products are much more complex and their advice to their clients and the insurer is highly valued. We believe technology should be leveraged to elevate and not eliminate intermediaries – essentially, blending the best of both worlds. As such, the partnership with My-Insurer/Wellnex makes sense, we have a shared vision to serve the intermediaries. My-Insurer/Wellnex provides huge value for the intermediary when they advise their clients while Surer provides the supercharging of processes to close the deal.” shared Derren Teo, Co-founder of Surer. The vision of Surer is to empower insurance intermediaries to be able to work with greater speed and efficiency. The benefits of a supercharged intermediary cannot be understated – they are the cornerstone of the general insurance industry where products are much more complex and their advice to their clients and the insurer is highly valued. Echoing this sentiment is Matthias de Ferrieres, CEO of My-Insurer/Wellnex. “My belief is that InsurTech has boundless potential to help intermediaries. However, no one company would be able to fully do so on its own. Partnerships like this will only help foster a greater sense of community and push the industry to the next, step change. The combined solution of My-Insurer/Wellnex and Surer will help in the digital transformation of intermediaries and the industry.” My belief is that InsurTech has boundless potential to help intermediaries. However, no one company would be able to fully do so on its own. Both Surer and My-Insurer/Wellnex are certified by the Singapore FinTech Association as an InsurTech service provider while My-Insurer/Wellnex is a Data Protection Trustmark Certified Organisation. My-insurer and Wellnex selected to show case its platform in Las Vegas Insurtech Conference9/12/2020

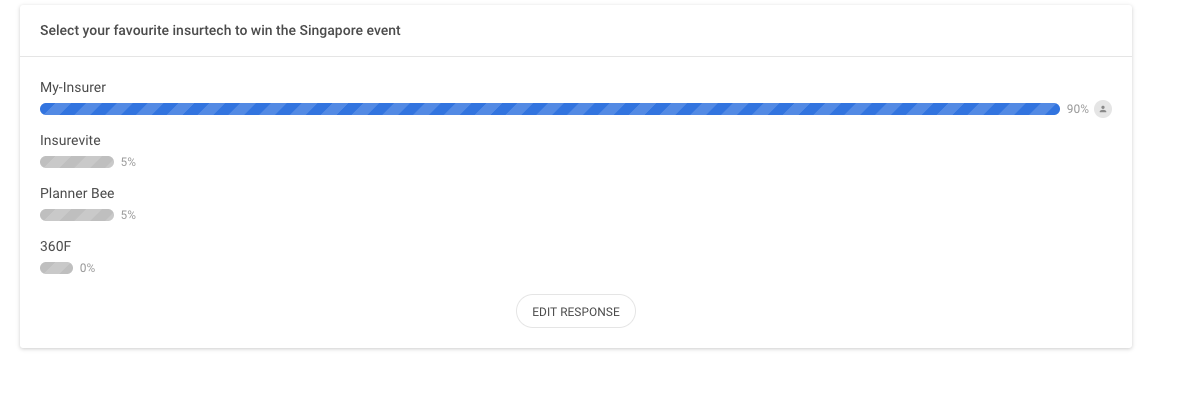

We are very proud to see that we have been voted in to represent the best Singapore insurtech at the ITC + DIA World Tour in Last Vegas next 21-23 of September 2020!

With 90% of the votes, the support of the participant has been very strong and we are very privileged to be considered as such! Thanks all the votants for your support! WELLNEX and my-insurer partner with Singapore FinTech Association (SFA) to offer 25% discount to all Singapore FinTech Association (SFA) members!

The Singapore FinTech Association (SFA) announced the launch of the Singapore FinTech Association (SFA) (SFA)'s Members-to-Members (M2M) campaign! The SFA M2M campaign is where they consolidate EXCLUSIVE OFFERS AND DEALS provided by SFA members and partners to promote collaboration and create synergy among the fintech companies. Whether you are looking for a digital onboarding platform, a cybersecurity solution or a new corporate card, we have got you covered - currently, more than 60 corporate members and partners from all fintech verticals are participating in the SFA M2M campaign, offering up discounts, cashback, exemption of subscription fees, and more! my-insurer has been selected to pitch at ITC + DIA World Tour this Friday September 11, 20209/8/2020

my-insurer will have the opportunity to be featured with its front-end Wellnex this Friday at the Insurtech Connect. We have prepared a video introducing our platform and show case the main features. Hopefully, we will be selected to move to the next step, which is competing with the one WorldWide. Let see where it leads!! About InsureTech Connect InsureTech Connect (ITC) is the world's largest insurtech event, offering unparalleled access to the largest and most comprehensive gathering of tech entrepreneurs, investors, and insurance industry executives from across the globe. Founded by Jay Weintraub and Caribou Honig, ITC has been attended by over 25,000 people from 65+ countries. InsureTech Connect Digital will be held September 1 - 23, 2020 & InsureTech Connect Asia will be held February 2-4 2021. For more information, please visit https://www.insuretechconnect.com.

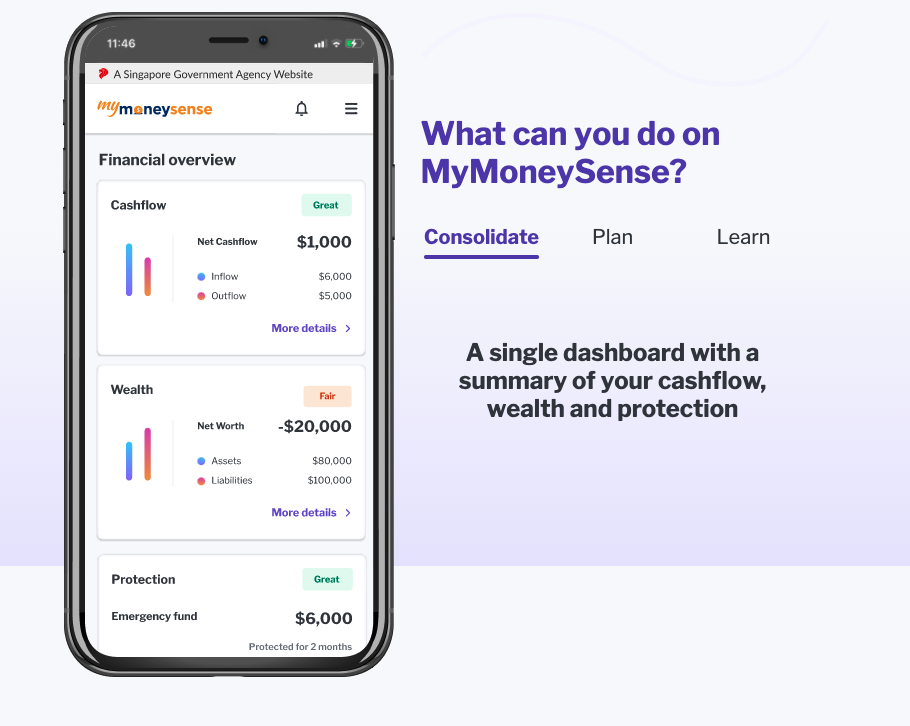

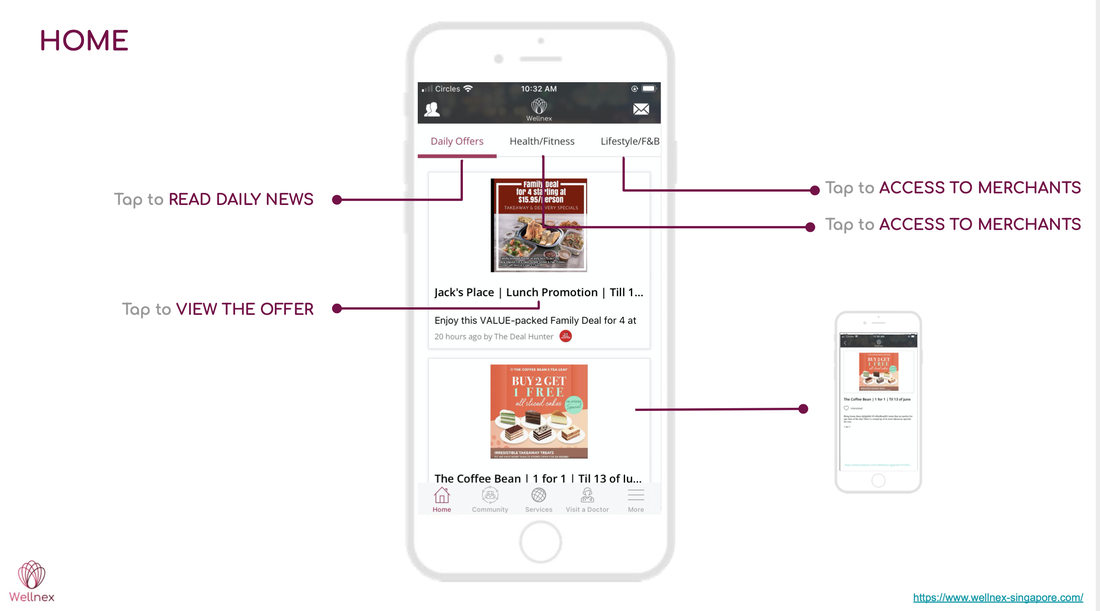

Finance Blog LifeJourney reviewed My Insurer and Wellnex with praise recently. Special attention was given to the simple interface and the opportunity for Financial Advisors and Lifestyle Vendors to reach a wider audience with a clear interest in Financial and peripheral matters.

|

my insurerDigitalising Financial Advisers Archives

April 2024

Categories |

The Leading Marketing Platform to offer your own branded app with content management

- Login

- Products

- About us

- News

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MoneyKakis >

- uWell >

- GainProtect >

- GER >

- Appple >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- OrpesCreo >

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |