Sebastien Khoo, Director of Wellnex to speak about the opportunity to generate lead more efficiently11/23/2022

WELLNEX Director Sebastien Khoo in partnership with First 4 Agency Irfan Dhamiry will be discussing the power of getting Leads efficiently through a proper marketing strategy!

In marketing, lead generation is the initiation of consumer interest or enquiry into products or services of a business. Generating a lead is being able to collect enough information to contact a potential prospect. In some cases, it includes on top of email or phone numbers, the demographic information of a customer who is interested in a specific product or service. There are multiple ways to generate leads. Here are what used to be considered as Foolproof Ways to Generate Leads:

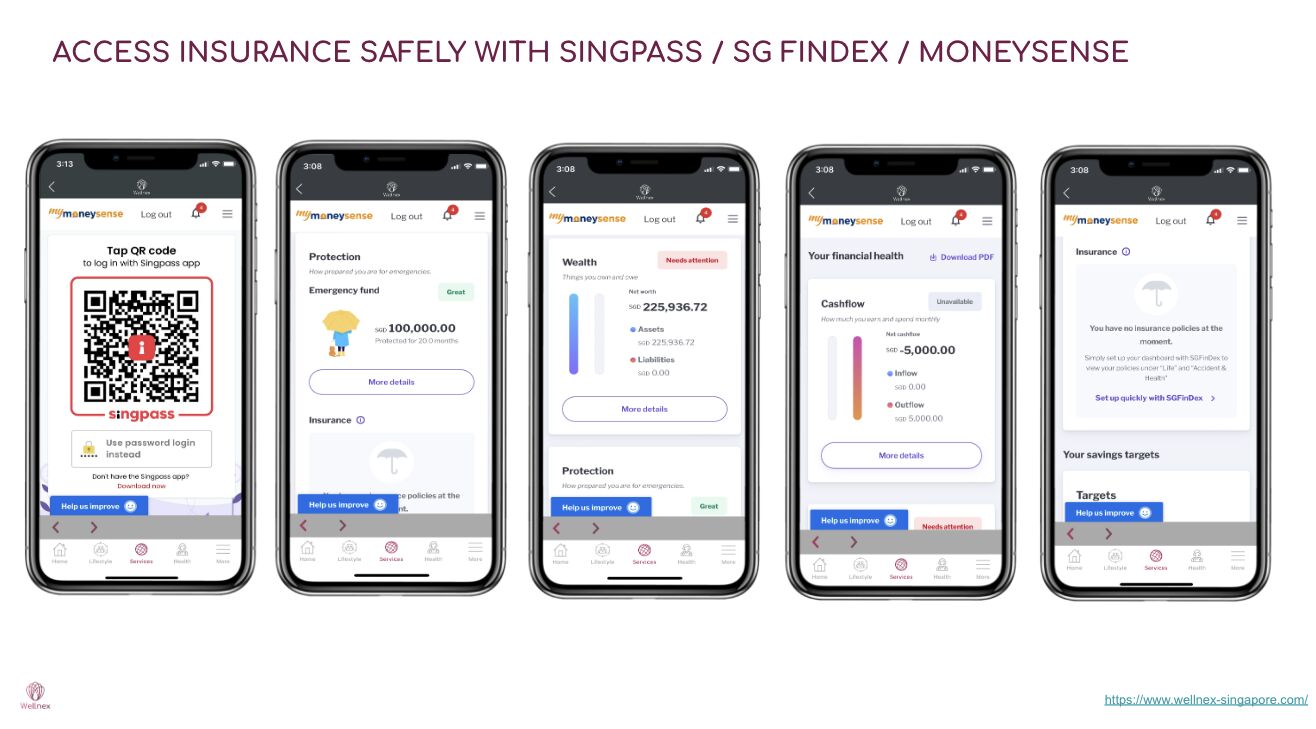

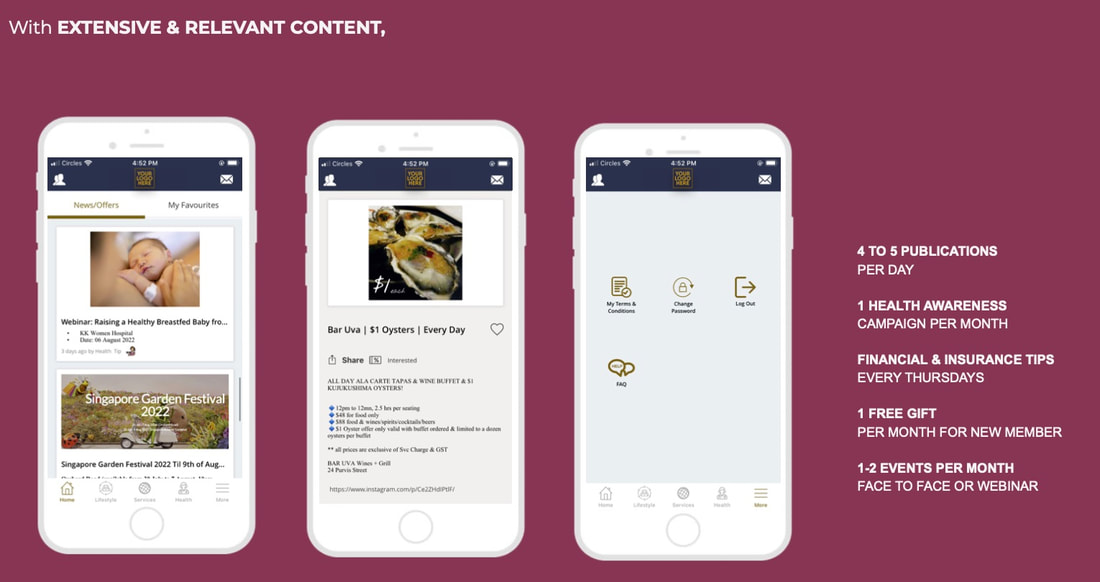

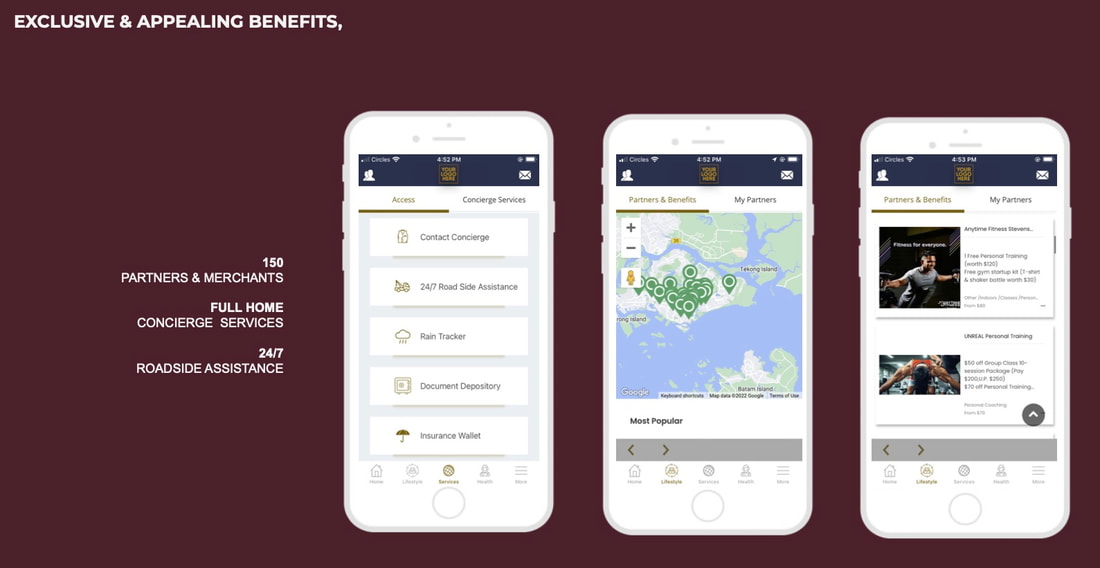

So come and join Sebastien and F4 Marketing Agency to hear what he has to say on what are the best ways to generate leads future long lasting clients! WELLNEX is the first private app that has plugged-in MoneySense, the Singapore’s national financial education programme that aim to help Singaporeans to manage their money well, and make sound financial decisions on their own. Now you can get access via SingPass and view all your banking and Insurance situation at once regardless the number of bank accounts or insurance policies from various insurers you may have! In 3 clicks, and in total compliance you have all your insurance centralised into the Wellnex app. On top of usual services such as discount and promotion from our merchant partners, dedicated concierge to organise your home services or book your next healthscreening, now you can view the details of your insurances!

Dr. Matthias de Ferrieres, CEO and founder of Wellnex confirmed that it does not matter if it comes from Prudential, Great Eastern, China Life, or AXA or even AIG, you will see all of them in one go through the Wellnex App or the white label! You will be able to download the pdf to keep it or share it to your financial advisor for a simple review. The access is restricted and safe as you will always need to get SingPass to login! In the spirit is mutualising all the services that are around protection (Financial, Home and Health) Wellnex responds a new needs in Singapore. WELLNEX is the first private app that has plugged-in MoneySense, the Singapore’s national financial education programme that aim to help Singaporeans to manage their money well, and make sound financial decisions on their own. Now you can get access via SingPass and view all your banking and Insurance situation at once regardless the number of bank accounts or insurance policies from various insurers you may have! In 3 clicks, and in total compliance you have all your insurance centralised into the Wellnex app. On top of usual services such as discount and promotion from our merchant partners, dedicated concierge to organise your home services or book your next healthscreening, now you can view the details of your insurances!

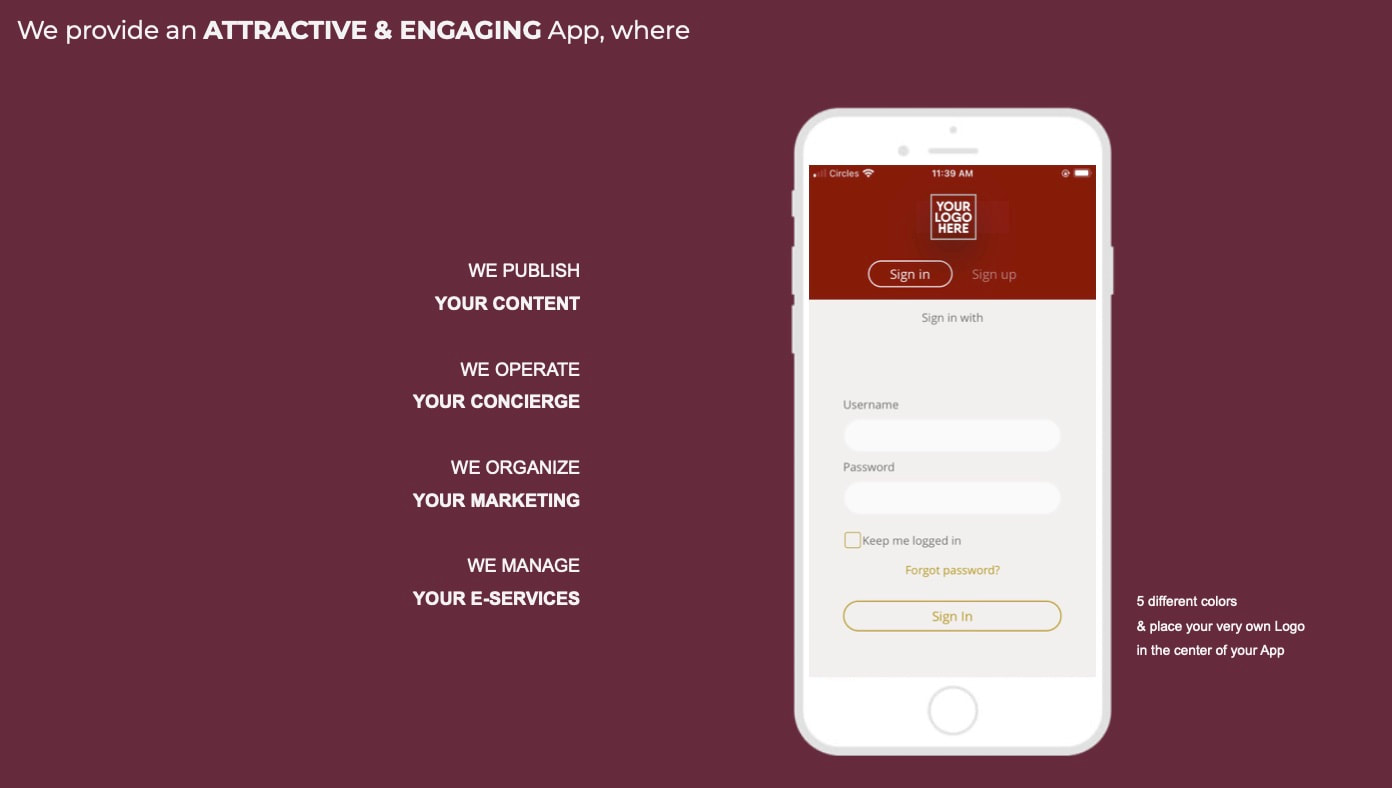

Dr. Matthias de Ferrieres, CEO and founder of Wellnex confirmed that it does not matter if it comes from Prudential, Great Eastern, China Life, or AXA or even AIG, you will see all of them in one go through the Wellnex App or the white label! You will be able to download the pdf to keep it or share it to your financial advisor for a simple review. The access is restricted and safe as you will always need to get SingPass to login! In the spirit is mutualising all the services that are around protection (Financial, Home and Health) Wellnex responds a new needs in Singapore. People run their lives from their mobile phones, from transport to food order, from news to getting informed. Digital technologies are also crucial for helping companies transform their business and engage their employees in improving their overall wellness. But not all companies have the resources to do so, especially small and medium enterprises (SMEs). According to a research done by Prudential, 54% say that mobile devices and healthcare apps are critical for preparing to live longer. About 85% say they are skilled at using mobile banking applications, while 73% are well versed in using mobile applications to monitor their physical health. Supporting the local workforce A Prudential poll in April found that only 21% of SMEs say they are already digital, while 64% say their companies intend to or are working towards that goal. Those who have not achieved their digitalisation goals have cited a lack of talent with digital skills, high cost and lack of training to do so effectively. That’s why My-Insurer launch Wellnex White Label to support SMEs in their efforts to offer a proprietary digital-ready platform dedicated to their staffs and delivered through their OWN BRAND IDENTITY! “ Wellnex White Label offers a corporate wellness programme to encourage SMEs and their employees to be more proactive in caring for their well-being through their very own personalized platform. According to My-Insurer’s April 2022 SME poll, company employee benefits are crucial to employee attraction and retention. Still, most SMEs do not have the budget to offer such. For 85% of the respondents, it is a priority for companies to provide employee benefits. Helping SMEs be more productive In October, My-Insurer launched Wellnex White Label, to help SME employees manage their employee benefit conveniently and seamlessly. The app is a single, one-stop digital platform that simplifies access to employee benefits and helps SMEs and their employees be more productive. It is accessible via the Wellnex by My-Insurer (Wellnex) app to My-Insurer’s enterprise customers, from large multinational companies to small businesses with at least three employees. Employees can view details about their medical and employee benefits to know what they are covered for, submit claims through the application by simply taking a photo of the receipt and uploading it to the app, and track their claims — features that SME employees had said were important in a tool for managing their benefits, My-Insurer’s April 2022 SME poll found. Employers and human resources (HR) teams can also efficiently manage their group insurance and process employees’ claims. “By making it simple and easy for employees to access their group insurance through the app, we want to encourage more companies to provide the necessary protection for their workforce. Employees will appreciate being able to tap on their company’s health and benefits programmes especially given rising healthcare costs,” says Goh. My-Insurer is also working with SingHealth and Fullerton Health to deliver training and webinars on health prevention. “Ultimately, we want to help SMEs in Singapore have a chance to be on the same level-playing field as large corporations by empowering them with skills and tools to help them optimise processes as well as care for their employees better,” says Matthias de Ferrieres, Founder of My-Insurer. Stay healthier and wealthier for longer

“With Wellnex, employees can leverage Wellnex White Label for their company benefits and tap on other features in the app to manage their health and wealth. Once these parts of their lives are managed properly, they can focus on being more productive at work,” says Matthias de Ferrieres. “Singapore is a widely connected country, with many of us owning a mobile device. Wellnex allows us to put essential healthcare and financial planning resources in the hands of Singaporeans so that we can help them take charge of their well-being,” says Matthias de Ferrieres. “What makes Wellnex unique is that it combines everything — health, Lifestyle and wellness — together. These encapsulate one’s total well-being.” These health and wealth components in Wellnex can be accessed by SME employees and members of the public who download the Wellnex app. The health features on Wellnex are designed to make healthcare more accessible by supporting users in their health journey to prevent, postpone, and protect against the onset of chronic disease. Overall, My-Insurer’s efforts align with Singapore’s goal of being a Smart Nation. Matthias de Ferrieres says: “Digitalisation is a goal that everyone [individuals and businesses] is working towards, and we want to be there to support them in their journey. Ultimately, we want to create an inclusive nation where digitalisation is accessible to all.” |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |