|

M-Insurer and WELLNEX expands with the recruitment of Sebastien Khoo as Business Development Manager!

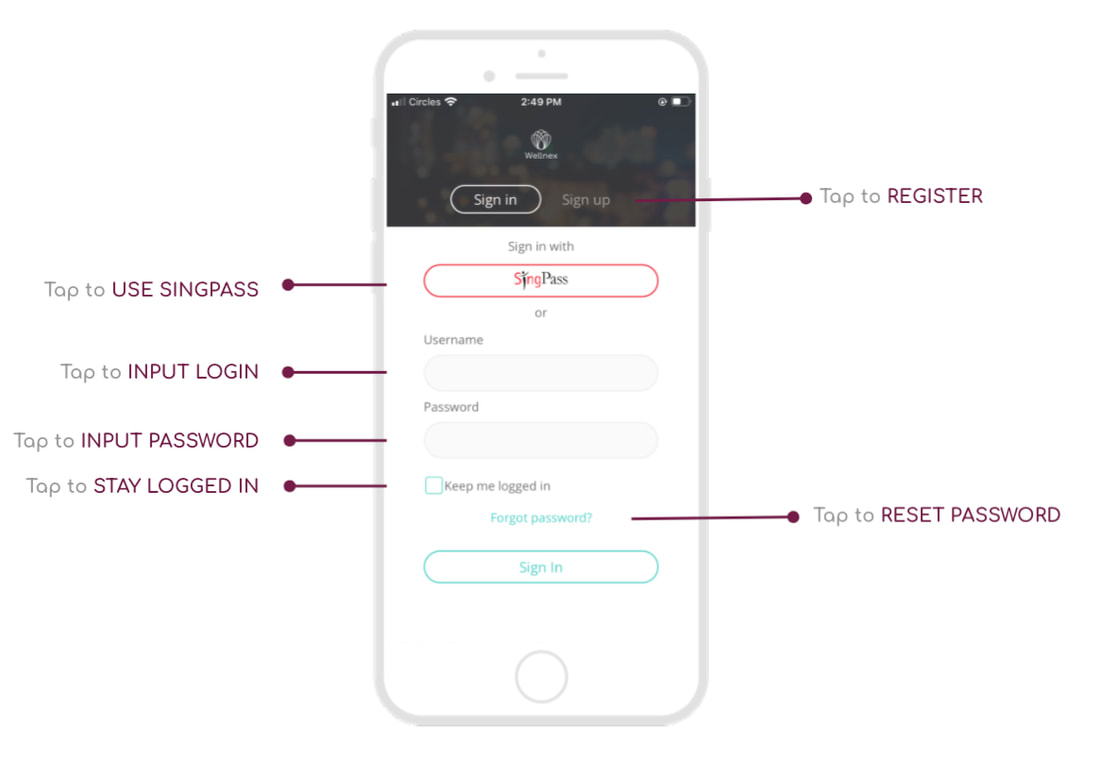

Sebastien Khoo has spent his life using his personal and career experiences to help his clients create solutions. He helps financial professionals to build an audience and to navigate the increasing changing financial advisory landscape in Singapore. Before joining Wellnex, Sebastien spent five years as a non-commissioned officer in the Republic of Singapore Air Force and learning his trade in the insurance industry with AIA FA. After a successful stint in Premium Care Singapore, helping advisors and their clients navigate the medical landscape, Sebastien will developing the business of My-Insurer and Wellnex and helping the team to bring the company to a new edege Check out the list of the companies, start-ups, and other websites using SingPass the and you will realise that we are the only Insurtech in Singapore. Which makes My-Insurer quite unique and reliable in term of safe access and privacy of data! What is Singpass?

Launched in March 2003, Singapore Personal Access (or Singpass) allows users to transact with over 60 government agencies online easily and securely. Managed by the Government Technology Agency (GovTech), the Singpass system is reviewed regularly, and there are many on-going security enhancements to ensure that a secure Singpass service is delivered to our users. Over the years, Singpass was enhanced to include an improved user interface, mobile-friendly features and stronger security capabilities, such as Two-Factor Verification (also known as 2FA) for digital transactions involving sensitive data. With 2FA, users will need to enter their Singpass ID and password, then followed by a One-Time Password (OTP) sent via SMS, or use Singpass Face Verification that serves as an additional layer of security.Users should also play their part to protect their account and personal information. |

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |