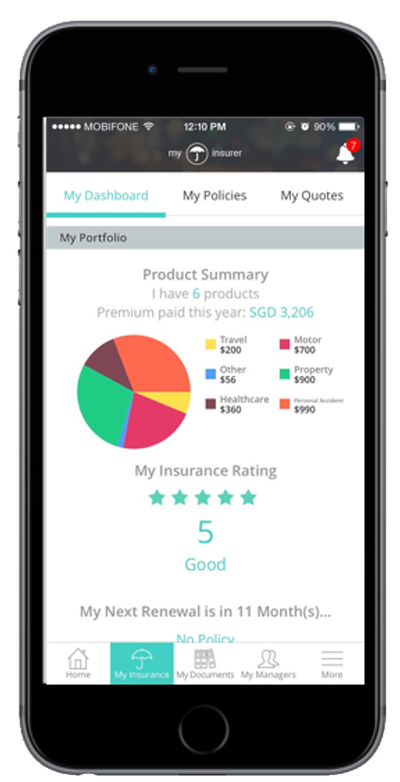

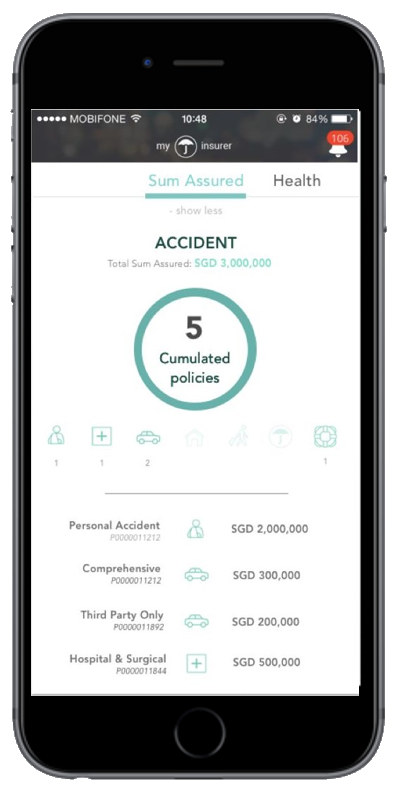

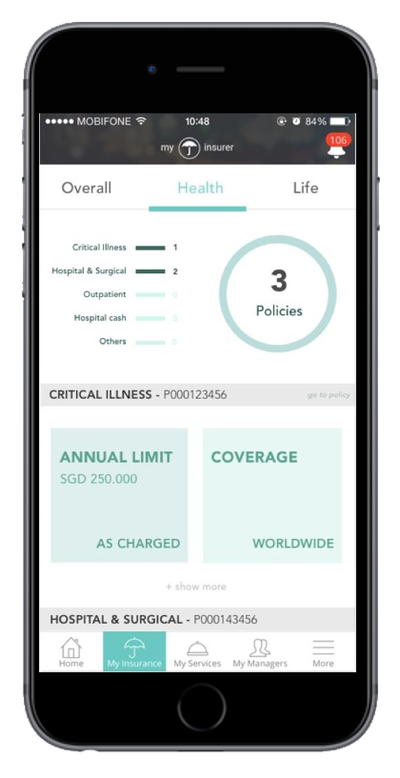

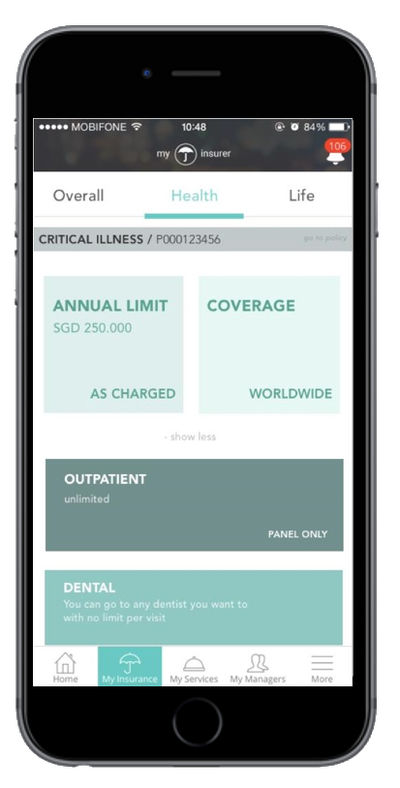

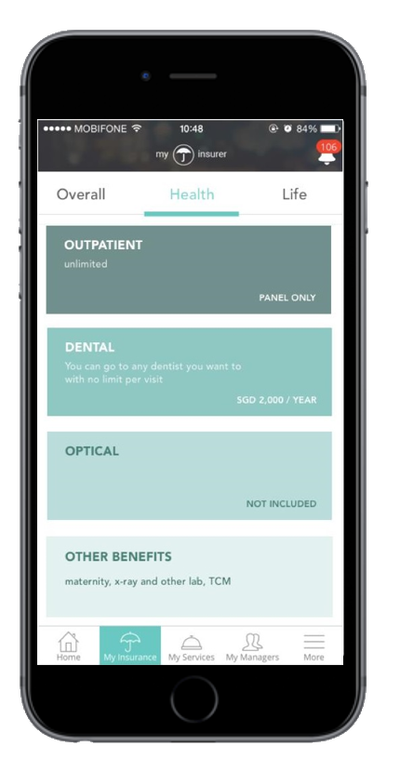

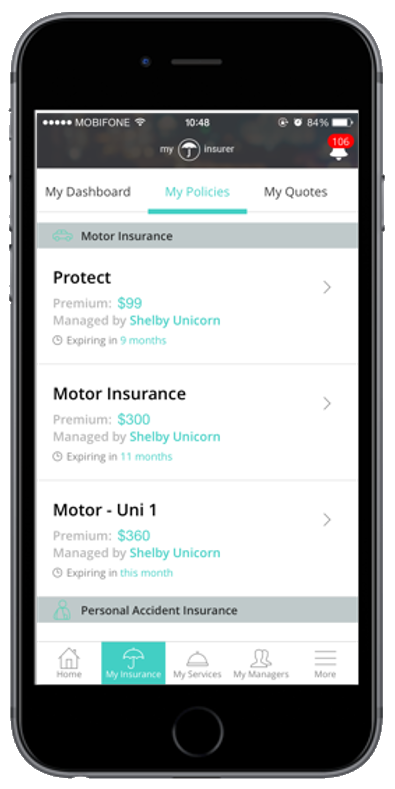

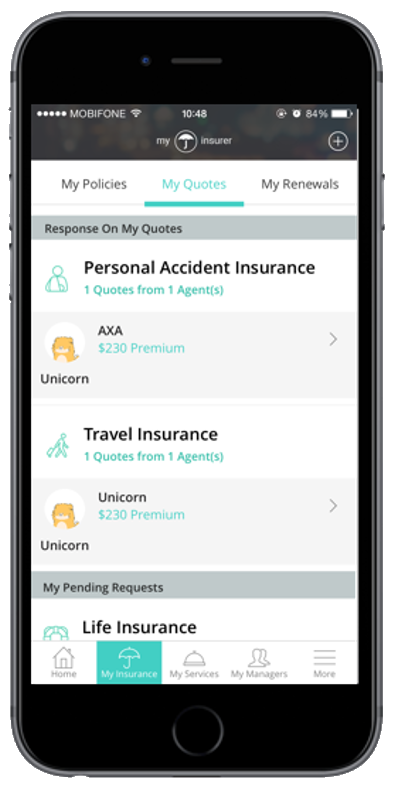

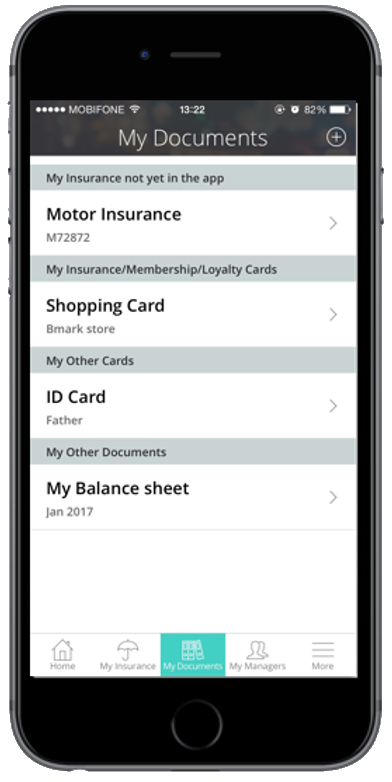

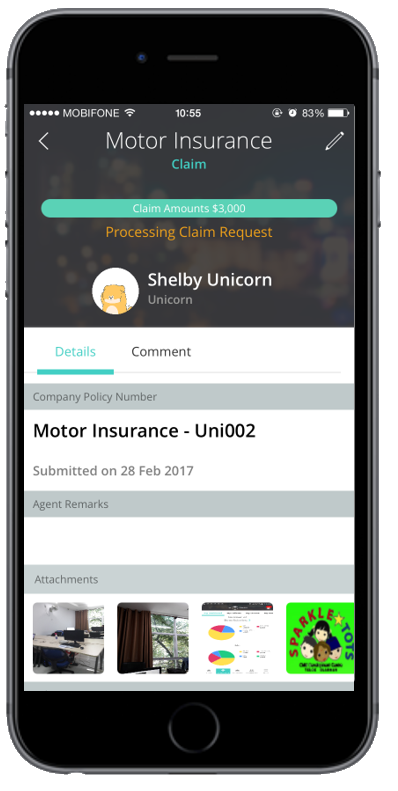

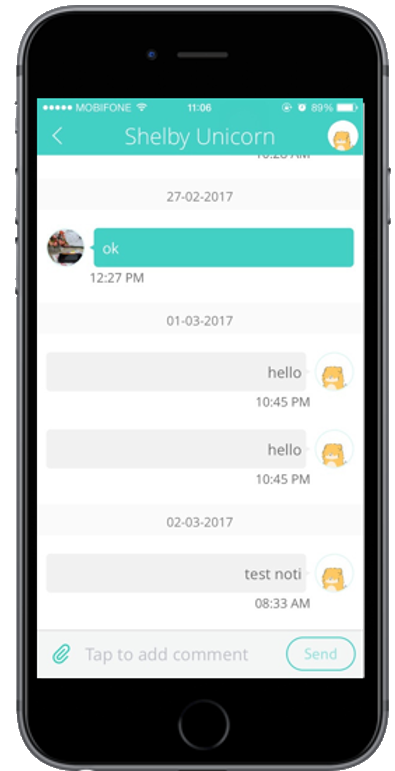

My-Insurer is the first mobile application in the market that serves both intermediaries and customers; a back-end system that serves and supports the consumer-centric front-end application. It aims to improve the operational efficiency of insurance agents, brokers and financial advisers, by helping them consolidate customer databases and remove the need for endless spreadsheets. The platform also helps connect intermediaries to interested customers. If a customer and an agent connect through the my-insurer app, they will be able to communicate through an in-built chat function, and the agent is able to push news, updates and information to his clients via the news feed function. In short, the platform has a look and feel that is similar to a social media app, but one that focuses on insurance agents and their customers. The app has reached 1000 users daily. [1] The FundEast team had the opportunity to talk to Ms Regine Lai, Managing Director of my-insurer under Stark Group. She joined the my-insurer team in May to effectively launch the app and on-board their first partners. With more than 10 Years of experience in Business Development, she is in-charge of making my-insurer the first and preferred insurance app for both intermediaries and insured. 1) What excites you about the current Financial Environment we live in? Is there something which you are afraid of? There are certain market leaders that have pushed boundaries that was hard to penetrate a year ago. We are getting more recognition and the market itself has more knowledge. People are taking notice of this space, its potential and the things that need to be done. When it comes to the question of whether or not the insurance business will change, it definitely will, the question is when. What we can see now is that people acknowledge the change that needs to be made. I am not afraid of anything as every day is organic, there could be failure, but failure is also a form of change and I believe that only from there, are we able to move forward. It’s better than remaining stagnant especially in the fast-paced and ever-changing business that we are in. 2) What makes your technology stand out from the rest of your competitors ? How did you come with the idea for your FinTech ? my-insurer is the only one in the market with this kind of technology. Matthias de Ferrieres (CEO of Stark Group) and I are more radical in this aspect. It has been two years since the technology in Asia started increasing more rapidly, yet, most of our competitors remain very much consumer-driven. The intermediaries are extremely important, yet no one is overseeing them. Agents and brokers are not going anywhere in the next 10 to 15 years as there is still a lot more underwriting and nuances that comes with heavily premium insurance. Unlike investments, insurance is not about making money or something we can buy online. Therefore, as consumers, we generally tend to forget how it is a daily essential and we do not make the conscious effort everyday to educate themselves with the power of insurance. Therefore, the information still has to be fed and the only way we can do that is through another person. Technology has yet to do that, which is why I strongly believe that intermediaries are here to stay. There is still a lot we can do to help intermediaries who are very pertinent in contributing to the sales and movement of the business. 3) How does my-insurer help intermediaries such as agents and brokers ? Our solution essentially focuses on helping intermediaries streamline their business better. We try to improve efficiency and effectiveness by reducing the need for manually combining data from their principal portal with multiple excel sheets and printed documents. Even with management systems, the data is not translated. This kind of technology has rendered certain job roles void and useless. However, the relationship between consumer and agent is still a major value proposition that leads to the success of the company. my-insurer makes it easier for agents to find consumers they can do business with and vice versa. The kind of relationship that my-insurance can establish goes way beyond traditional insurance. It isn’t just about sending in birthday vouchers or reminders to renew the contract. Through our solution, we hope to establish constant communication that allows knowledge transfer, quotation requests, marketing materials. Overall, streamlining their entire workflow process and making every information readily available. Better utilizing the time agents traditionally spent looking for policies and information, building relationships and clinching more opportunities. 4) Do you think that your competitors will develop the same type of technology that you have in the near future? Matthias and I are not just software developers, we have also been in the insurance business for a long time. Therefore, we have knowledge of the regulatory and the clients but we just don’t actively sell insurance on the ground, we leave that to our partners who also use our product. The chances of our competitors duplicating our product is almost zero. As our dashboard is so comprehensive that there is not anything like it, not even 10% close to it, on the market as of now. It is extremely difficult to craft that kind of technology. It may seem easy on the interface, but in the back end, it is a lot of heavy-duty work. 5) Has your previous work experience and knowledge helped in the development of your FinTech solution ? Being in the insurance business for so long, my core strengths include reaching out to my connections in different networks and also presenting business proposals. I consider myself a commercial person. At the same time, if I am filling a very specific gap in the market which companies have been thirsting for. It is not just from something I developed but with crucial details going back to agents’ day-to-day transactions refining the product as we see fit. The product has undergone changes and is different from how it was two months ago. My partners, agencies and directors play a part in shaping the product to the way it is now. I give them exactly what they want, down to the smallest details, leading them to adopt and support the product completely. 6) How did you get funded ? Since the beginning, our company has always been self-funded. Believe it or not, until today, we have spent a grand total of $0 on marketing. We could be looking at funding at some point of time. We will see the rate of development, amount of data and costs, which are are extremely costly. 7) Marketing is an important aspect of any business. How did you manage to achieve this ? Our business model is that we don’t spend on marketing. Our agents are our marketing source. They see a value proposition in this, they are our best word of mouth. They would be the ones on-boarding their customers, as they know how beneficial it would be for them and the best way to move forward. We believe they are the best proponent of our product, just like how they are the best proponent of the products that they sell to the customers. They know that when their customers get on this app, it is a win-win situation. 8) Do you think Fintech is destroying jobs ? I always believe that it is always for someone to create a value proposition for themselves to survive in the market, it is not about something replacing you. I do not think that we have come to a stage whereby AI can totally take over humans. There is one thing that humans can do that technology can’t do, it’s the emotional connection and relationship that we form. If in the past if the machine can do 0% and now they can do 80%, you need to make sure the 20% are really efficient, which is what we are doing with our agents now. Helping people to create value for themselves. 9) What advice would you like to give to someone who is just starting out in the FinTech industry ? I think first and foremost, you really need to identify the gap in the market, you need to create something that will be able to move the market and not just about creating noise. Matthias and I don’t believe in creating a product that is extremely innovative, never before seen but doesn’t change the industry. We are still around because we run the business like a normal business, making sure we have decent revenue, keeping costs low and spending money wisely. Not looking for the next funding to support you and to see whether it is worth to spend on certain developments. 10) Where do you see yourself and your company in the next 3 years ? The scalability of this project has a lot of potential. There are so many things we still want to do. Next year, we will be looking at collaborating with more corporate partners. Right now, we are working with DBS running some tests. Once they announce their insurer, we will probably kick start the project with them. Agency level, we hope to get as many people on board to get the critical mass. For us, I want to have as many users as possible, a good critical mass. Hopefully, everyone will have this app for their insurance needs and maybe even investments. 11) What has been your proudest moment in the history of your business and why ? I definitely think it is this solution. Firstly, it is the first in the market. Secondly, I am taking care of a good part of a business which has been neglected for way too long, and that nobody has done anything despite agents being one of the biggest contributors of the sales force in the business. It is also a very big thing when agents appreciate you and show gratitude towards you. I’m a people’s person, so when I hear people saying thanks and knowing that the app helps them, that my product is being used by someone contributing to the workforce, it is very good. It was a pleasure talking with Ms Regine Lai. Ms Regine being so energetic, hard working and focused, makes us forecast “my-insurer’s” imminent success, Regine stands out to be one of the leading women entrepreneurs in Singapore who is definitely going to “Grab the bull by its horns”. https://fundeast.com/catching-up-with-my-insurer-ms-regine-lai/ Comments are closed.

|

my insurerDigitalising Financial Advisers Archives

July 2024

Categories |

- Products

- About us

- Security

-

CLIENTS

- Wellnex >

- iOCHO >

- Beyond Group >

- Alpha >

- Wealth Grandeur >

- PreferredOne >

- DKO >

- APEX >

- Onlivips >

- AniMall >

- MediMaid >

- Funsplash+ >

- GainProtect >

- GER >

- Trip'in >

- MediPass >

- iSpartans >

- A$Khim >

- Singcapital >

- ClubMax >

- Thrivewell >

- Invictus >

- GEN >

- Odyssey Advisory >

- Luminous >

- Twenty30 >

- Aspire >

- USE >

- SG Alliance >

- Virtus >

- Pinnacle >

- TGT >

- PFP >

- AWFA >

- TFC >

- OpesCreo >

- DNA >

- The Global Investor >

- True North Financial >

- News

- Ask for A demo

important notice |

about us |

Term of USe |

|

My-insurer Pte Ltd formerly known as StarkGroup Pte Ltd

My-Insurer is Private Limited company based in Singapore Wellnex is the platform, the front-end of My-insurer DPTM Certification Number: DPTM-00033-202008202008 Cyber Essentials Certification Number: CEM-2023-012 Our people Latest Features |